Dollarization in Latin America

Is it desirable?

Walmart in Mexico

At the dawn of the XXI century, the drastic lowering of barriers to foreign trade and financial transactions, coupled with the volatility of international capital markets, seem to be propelling the world towards the elimination of monetary divisions. Indeed, a number of regional experts and business leaders -in export oriented sectors-argue that Latin America should abandon its diversity of local monies and adopt the United States dollar as its common currency. In brief, they consider that such formal dollarization is not only unavoidable for Latin America given the increasing globalization of production and finance, but also a necessary step to promote the region’s dynamic insertion into the world economy. In their view, this monetary reform, by eliminating all uncertainty regarding nominal exchange rate variations, would produce enormous benefits for the region: greater price stability, reduced transaction costs in foreign trade, lower inflation and interest rates and thus healthier banking systems and higher levels of economic activity. However, notwithstanding its potential benefits, the surrendering of monetary sovereignty entails important costs and risks that should not be overlooked.

The different paths of inflation in Latin America and the United States are likely to create complications. Inflation in developing countries is caused by structural, deep-seated factors that go beyond the mere influence of external prices or monetary expansions. These factors may include distributive struggles, fiscal imbalances, as well as a more heterogeneous evolution of productivity in the various branches of economic activity. Moreover, certain rigidities in pricing of goods and services as well as in labor contracts create inertial inflation. These factors may stop Latin America’s inflation rate from reaching U.S. levels, even with full dollarization. Moreover, if prices of Latin American goods and services would keep expanding at a faster pace than those of its competitors in the United States market, dollarization would end up deteriorating the region’s international competitiveness. Ultimately, it would slow down the expansion of regional production and employment. Such effects, if persistent, may eventually plunge Latin American economies once again into a long-term decline and acute levels of unemployment and under-employment.

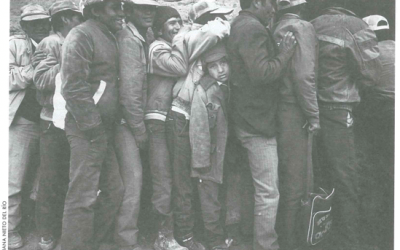

No developing economy-irrespective of its monetary or exchange rate policies- is immune to the impact of abrupt changes in the global economy that may drastically alter the demand for its main exports, its foreign investment, or even its access to international financial markets. Consequently, however credible and convenient Latin America’s dollarization may seem, it does not guarantee that the region will never again suffer external shocks that mandate macroeconomic adjustment programs. Such occasions would be a severe test of the viability and adequacy of dollarization in the region. Countries with formal dollarization may never modify their nominal exchange rate, so any adverse external shock in the world economy would have to be accommodated by cuts in the nominal level of its domestic wages and prices. However, the widespread dynamics of monopolistic competition in Latin America and the rigidities in many of its labor markets-deeply rooted in the region’s tradition of high inflation- make it difficult to implement major cuts in nominal wages without risking overall political and social stability. In such circumstances, breaking the inertia in price and wage formation may require deeper and more prolonged reductions in real output and employment than those deemed necessary under a policy of floating exchange rate. Therefore, the burden of domestic macroeconomic adjustment required to face external shocks would lie even more heavily on the workers and underemployed. And, unless radical changes in the region’s labor and production are implemented, dollarization would likely elevate the social costs of macroeconomic adjustment relative to those in economies not fully dollarized, that still have the option of flexible exchange rate policies.

These social costs may be particularly high because Latin America lacks typical compensatory mechanisms to reduce the impact of contractionary shocks by channeling resources to regions affected by adverse circumstances. Indeed, welfare and unemployment benefits are largely absent in the region. The core of the region’s social security system barely protects a minority of workers, those employed in the modern sector of the economy.

If Latin America should adopt the US dollar as its unique and official currency, it would cancel out all possibilities of an independent monetary policy. Key monetary variables like money supply, credit, and nominal interest rates would then be decided -implicitly or explicitly-by the United States Federal Reserve. There is no guarantee whatsoever that, in such situation, the Fed’s decisions will be favorable to Latin America’s economic development. As its chairman, Alan Greenspan, has said, the Federal Reserve takes only into account the interests of the United States economy. In addition, the Deputy Secretary for the US Treasury recently stated that any country contemplating the use of the American dollar as its formal currency should first consult the relevant American economic officers and in any case be aware of its potential consequences, favorable or not.

The loss of autonomous monetary policy would, in particular, imply that any Latin American economy embarked in dollarization would be unable to provide financial support for its domestic banking sector even in cases of severe crisis such as Mexico’s. Thus, under full dollarization, such financial institutions would likely have to cease their operations. Therefore, the substitution of local currencies for the US dollar, though helping to avert Latin America’s recurrent foreign exchange and balance of payments crisis, may simultaneously make the region more prone to banking crises and severely tight credit restrictions. Is it economically sound to let such banks go broke, instead of temporarily providing extraordinary financial resources to restructure them? This is a decision to be carefully weighed by national governments and should not be a mere consequence of the implementation of a formal dollarization of the economy.

Given the above mentioned limitations and risks, dollarization may easily end up being a costly and failed experiment in Latin America’s quest to guarantee price stabilization. To achieve price stability in the region may prove to be an elusive goal. But in its pursuit, policy makers should take into account the potential risks and costs of such policies in terms of the fulfillment of other relevant economic and social objectives.

However, even with the above-mentioned limitations, some argue that the road ahead for Latin America is nevertheless rapidly moving towards integration with the United States economy, forming a continental Monetary Union. Such monetary arrangement would go beyond the adoption of a common currency. It would also imply free movement of labor and capital in the region as well as a common fiscal policy with explicit arrangements for compensating economically disadvantaged areas.

A monetary union with the United States may or may not be sound strategy for Latin America, but major political, institutional and economic factors must be taken into account. First of all, there is no political will within the United States to embark on such a continental monetary union. And even in Latin America, the consensus does not favor any movement in that direction. In fact most of the region’s Finance Ministers oppose such radical monetary rearrangement. Secondly, and most significantly, it would be necessary to agree on a timetable for the removal of all restrictions to the free movement of capital and of labor within the region. As it is painfully evident for millions of Latin Americans, there is no political support in the United States to lift the restrictions on the entry of foreign workers.

Even for Mexico, by far the economy most closely integrated with the United States, the possibility of establishing a monetary zone is not an option in the foreseeable future. Neither the objectives and the necessary steps to achieve them, nor the timeframe or the required institutional framework have even been agreed upon or identified.

For the time being Latin America, notwithstanding its rich cultural tradition of magic realism (Realismo mágico-so marvelously expressed by GarcÃa Márquez, among others) should refrain from believing in dollarization as a magical cure for its real economic illnesses. Adopting as a common currency for the region the US dollar or a newly minted one with the face of Columbus -or for that matter Ricky Martin- without ensuring the necessary changes in its institutional and economic structure, including the free movement of labor into the United States may easily end up hindering Latin America’s economic development.

Fall 1999

Juan Carlos Moreno Brid, a DRCLAS Research Associate, specializes in Latin America’s economic development. This article is partly based on joint work with David Ibarra to be published in Pucher, M.& L.Punzo, (Eds). Mexico Beyond NAFTA: Perspectives for the European Debate, Routledge Press.

Related Articles

Poverty or Potential?

Teresa stops me three blocks from Nueva Imperial’s main plaza on a quiet Wednesday morning, eager to chat. She is wearing a light blue sweater and a matching blue headband glowing slightly against her dark black hair.

Infections and Inequalities

I read Paul Farmer’s book while on a short visit to Venezuela, and found that setting, at this historical moment in time, particularly pertinent and highly conducive to the arguments Farmer…

Proclaiming the Jubilee

Carmen Rodríguez heads the Charismatic Movement in a sprawling shantytown parish south of Lima, Peru. She and other lay leaders of the Lurín Diocese have been preparing for the…