Energy and Politics in Brazil

A Retreat from Oil Nationalism

With Brazil’s state oil company Petrobras engulfed in a massive corruption scandal, the government looks poised to introduce an energy sector overhaul that would reverse a trend of using state-run companies to drive economic development. While most of the details of the scheme have only recently come to light—creating a political crisis for the president just as the economy is faltering—the corruption scandal follows years of political interference in the management of Petrobras and in energy policy more broadly.

The bribery scandal first came to light in March 2014, when a senior executive, Paulo Roberto Costa, was arrested on charges of money-laundering. In a plea bargain, he revealed a vast kickback scheme that involved inflating Petrobras contracts and pocketing 3% of the value. Many of the company’s top executives and senior government officials, including some from the ruling Workers Party, have been implicated.

The scandal has reached the highest levels at the company. Jose Sergio Gabrielli, Petrobras’ chief executive from 2005 to 2012, had his assets frozen by a court order in January. Although Gabrielli’s successor appears to have had no involvement in or prior knowledge of the scheme, the appointee Maria das Graças Silva Foster—a close friend of President Rouseff—resigned under pressure on February 4, along with five other Petrobras executives. Several top executives have since received fines and prison terms.

The scandal’s financial repercussions are particularly painful for the world’s most indebted company, with some of the largest annual corporate investment plans globally. For several months, Petrobras was unable to calculate its losses from the bribery scheme, preventing its auditor Price Waterhouse Cooper from approving its financial statements, originally due in November. In late April, Petrobras finally released its audited financials, dodging a technical default that could have blocked it from international capital markets. The company reported a $16.8 billion write down, or reduction in the value of its assets, including more than $2 billion from corruption. Not surprisingly, Petrobras stock has taken a hit, falling from $72 per share at its height in 2008 to around $5 per share in March, recovering slightly after its financial statements were released.

In a significant reversal of past policies, Petrobras is now taking steps to improve its balance sheet and restore investor confidence. It announced it will not issue any new foreign debt this year, and its latest 2015-2019 business plan, published in June, includes an aggressive 37% reduction in capital spending compared to the previous plan. Petrobras also plans to divest some $15.1 billion worth of assets. The decline in global oil prices unexpectedly has a silver lining for Petrobras. While Brazil’s government-controlled fuel prices generated losses for Petrobras in past years when international oil prices were high, retail prices in Brazil are now above international import prices, yielding a profit for the company.

Belt-tightening at Petrobras, while necessary under the current circumstances, could hurt the company in the long run. Its oil production has been flat over the past five years despite the discovery of some of the largest oil reserves in the world off Brazil’s shores, known as the “pre-salt.” It has repeatedly missed production targets over the years and in June announced a steep reduction in its 2020 oil output target from 4.2 million to 2.8 million barrels per day. The company has banned 23 of Brazil’s largest engineering and construction firms from future oil and gas exploration auctions because they were allegedly involved in the scandal, leaving few qualified suppliers in a country with particularly strict local content rules. For now, its divestment plan is targeting less important assets in refining and distribution, international holdings and marginal oil fields, but if the company’s weak cash position forces it to sell larger core assets in the future, its long-term growth will be compromised.

TROUBLES AT PETROBRAS

While the corruption scandal has revealed a new depth to the troubles at Petrobras, it comes on top of years of problems tied to political interference in strategic decision-making. Following Petrobras’ discovery in 2007 of the pre-salt reserves, then-President Luiz Inacio Lula da Silva, also of the Workers Party, presented a bill to Congress that increased government control over Petrobras. The state oil company remained partially privatized, a legacy of reforms under his more market-oriented predecessor in the late 1990s, but the government increased its stake in the company and made Petrobras the exclusive operator with a minimum 30% stake in all pre-salt fields.

The new regulations put a tremendous financial and operational burden on Petrobras and restricted international oil companies’ participation in exploration and production in Brazil. Other politically motivated decisions, such as the fuel price caps, strict requirements for using Brazilian equipment and services, and the building of expensive refineries in the poor, less populated Northeast for economic development purposes, further undermined Petrobras’ finances and ability to manage its complex projects.

Similarly, in the power sector, unsustainable price controls were implemented in the name of economic development. In 2012, the government forced power generation plants to cut their prices in order to aid large industrial electricity consumers, weakening the finances of power companies. Last year, Brazil faced a major drought that reduced supplies of cheap hydroelectric power, forcing utilities to use more expensive natural gas. However, the government did not allow companies to raise their rates but loaned them money instead. Now, to shore up its finances, the government will have to cut subsidies and raise rates.

At Petrobras, politically driven decisions had frustrated the rank and file long before the corruption scandal was made public. One Petrobras project manager told me last year that Lula had “destroyed the company” and that most of his colleagues were unhappy with the top management. While they respected Foster, an engineer and industry veteran, they had been skeptical of her predecessor Gabrielli, a political appointee and co-founder of the Workers Party with little experience in the oil industry.

Many of the company’s employees may also have known about the corruption for years although they were not involved. When I was a journalist covering Brazil’s oil industry, a senior Petrobras manager told me in 2013—before the scandal was revealed—that inflated contracts were behind the ballooning budget for Petrobras’ Abreu e Lima refinery in northeastern Brazil. The refinery project ultimately cost $18 billion compared to an initial estimate of $2.5 billion. Costa has since admitted to inflating the contracts for Abreu e Lima as part of the kickback scheme.

It is unclear whether Petrobras will gain more independence from the government in strategic decision-making under its new CEO. Petrobras’ new leader, Aldemir Bendine, who was head of Banco do Brasil, the largest public bank in the country, has close personal ties to the president. The fact that he is an outsider to the oil industry and thus safe from any allegation of involvement in the bribery scheme is certainly reassuring. But it remains unclear whether he and his new team will have sufficient freedom to manage the company.

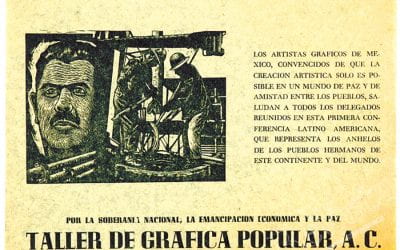

Petrobras headquarters: if the company’s weak cash position forces it to sell larger core assets in the future, its long-term growth will be compromised. Photo courtesy of Jason Dyett.

ECONOMIC AND POLITICAL FALLOUT

The state-led approach undertaken by both the Lula and Rousseff administrations is not confined to the energy sector. Over the last decade, Brazil’s economy has been weighed down by increasing public spending, rising debt and protectionist trade policies, while needed investments in its failing infrastructure and weak educational system have not materialized.

Now, these policies have become unsustainable as the global economic environment has turned hostile for Brazil. Economic growth in China, Brazil’s largest trading partner, has slowed, and prices for Brazilian oil, minerals and agricultural products have declined. Monetary tightening in the United States is expected to restrict the flow of dollars to emerging markets. Brazil’s economy grew only 0.1% in 2014 and is expected to contract this year. Its new finance minister, Joaquim Levy, is charged with imposing unpopular austerity measures to balance the budget and safeguard Brazil’s investment grade status, such as cutting public spending, reducing pension and unemployment benefits and raising taxes. The reduction in spending by Brazil’s largest company will only further undermine economic growth. However, the corruption scandal’s effects on the construction industry could be even more far-reaching for the economy. Many major Brazilian construction firms that were expected to execute the country’s ambitious infrastructure plans have been shut out of capital markets because of alleged corruption, or face potential bankruptcy as a result of reduced demand from the oil industry.

Public anger over the scandal has severely weakened the administration of President Dilma Rousseff, who kicked off her second term in January. Although the president herself was apparently not aware of the scheme, it coincided with her tenure as president of Petrobras’ board of directors. Already some opposition figures are calling for her impeachment and her approval ratings have dropped to around 10%. Hundreds of thousands of protesters have taken to the streets across Brazil in various demonstrations over the last few months to voice their anger at the president.

But the political fallout from the scandal could drag on. As more people are brought up for charges of corruption and offered plea bargains in exchange for information, the list of alleged offenders will likely grow. What’s worse, another corruption scheme that may be even larger in scale is emerging. In March, police and finance ministry officials revealed that over the past decade the government had been robbed of between $1.8 billion and $6 billion in back taxes and fines from various firms.

REFORMS AHEAD?

As these problems come to a head, Brazil is moving toward implementing reforms to root out corruption, stabilize the economy and revise its energy policies. The president has given investigators unprecedented freedom to prosecute criminals on corruption charges, proposed anti-corruption legislation to Congress and reshuffled her cabinet to realign her political ties and distance herself from alleged offenders.

In the oil and gas sector, an opposition congressman has already introduced a bill to reverse Petrobras’ obligations as sole operator with a minimum 30% in the pre-salt. Local content requirements, which the government has already loosened, will likely be further retracted. In both the hydrocarbons and electricity sectors, the government says it will raise prices in order to cut subsidies, and some government officials are calling for allowing Petrobras to set its own pricing policy.

Amid all the turbulence, the future may still be bright for Brazil’s energy giant. Petrobras maintains access to gigantic reserves and will eventually reach its production targets, even if not as quickly as originally planned. The company remains a leader in deepwater drilling capabilities, meaning it has the technological ability to develop these complex projects. There have been delays in starting production from new offshore fields, but tremendous progress has been made on the operational side since the first major pre-salt discovery was made eight years ago. Pre-salt production has now surpassed 800,000 barrels per day, and Petrobras’ total oil production in Brazil rose 5% to just over 2 million barrels per day in 2014.

However, beyond the drilling successes and the pending legislative reforms, the most important outcome of the scandal will hopefully be a new culture of corporate governance and transparency that has clearly been lacking at Petrobras.

Fall 2015, Volume XV, Number 1

Lisa Viscidi is director of the Energy, Climate Change and Extractive Industries Program at the Inter-American Dialogue. She writes about energy policy, social and environmental impacts of natural resources and the geopolitics of energy, among other topics. Follow her on twitter @lviscidi.

Related Articles

Oil and Indigenous Communities

On a drizzly morning in late February, a boat full of silent Kukama men motored slowly into the flooded forest off the Marañón River in northern Peru. Cutting the…

Mexico’s Energy Reform

The small, white-washed classroom at the University in Minatitlán, Veracruz, was packed with a couple dozen people who, although neighbors, had never met…

Geothermal Energy in Central America

When we think about global technology leaders, Central America does not typically come to mind. But Central American countries have indeed been in the…