The Benefits of Privatization

The View from Mexico

Throughout Latin America and in many other parts of the world, such as Eastern Europe people are asking if increased profits of privatized firms are a result of higher prices of products, and extensive layoffs and lower wages of workers of privatized firms. Critics often argue that the benefits of privatization come at a significant cost to society.

To what extent do price increases explain better performance? Do higher profits result from the expropriation of workers? Or does the improvement reflect better incentives to perform? In a recent joint study with economist Rafael La Porta, we looked at the evidence from Mexico, one of the world’s largest case-by-case privatization programs. We found dramatic improvement in the performance of the newly privatized firms, with operating profits rising as much as 24 percentage points.

In 1982, more than 1,200 state enterprises in almost every sector of the Mexican economy received subsidies and other transfers equaling almost 13 percent of the Gross Domestic Product. These state enterprises, however, produced only 14 percent of the national output, employed around four percent of Mexico’s labor force, and accounted for 38 percent of fixed capital investment.

The government began to unravel the state sector in 1983. By June 1992, the number of firms under state control had been reduced to less than 220 firms. Our study looks at data for 98 percent of all privatized firms. For each one, we’ve examined profitability, efficiency, employment, output, prices, and taxes paid before and after privatization

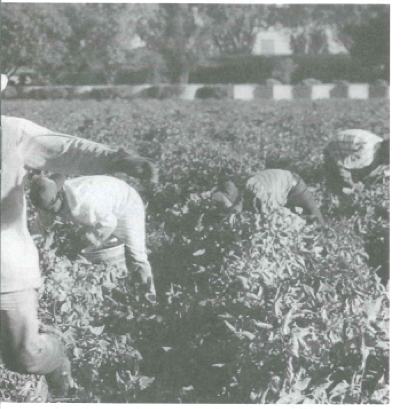

We found large increases in operating efficiency underpinned the gains in profitability in the Mexican sample. Average costs per unit plummeted 21.49 per cent, while the average ratio of sales to fixed assets rose 64.64 percent. The average sales per employee nearly doubled and operating income per employee skyrocketed. Employment cuts are part, but not nearly all, of the picture. Privatized firms reduced the number of white- and blue collar employees by half. Productivity gains are largely due to improved incentives. Privatized firms quickly bridge the pre-privatization performance gap with industry-matched control groups.

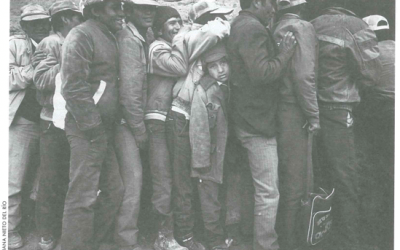

Working in Mexico

We examined four indicators of operating efficiency to capture changes in the ability of firms to extract output from a number of inputs. We found that sales increase quickly in the post-privatization period, although the stock of fixed assets remains basically unchanged and the number of workers falls sharply. This increased efficiency coupled with higher levels of sales translates into large gains in profitability. The industry-adjusted ratios suggest that privatized firms are “catching up” to the profitability and operating efficiency of their peers in the private sector.

In the year before privatization, half the installed capacity of most firms was idle, so no large investments could be expected. However, we found that investment indicators show a moderate increase in the rate of capital accumulation. The ratio of investment to sales increased from three percent to 4.5 percent. Thus, privatized firms were able to increase sales despite halving their workforce and increasing their capital stock only modestly.

Moreover, in answer to politicians prayers, privatized firms became significant taxpayers. Slightly more than half their gains in operating income go to taxes, offsetting transfers from the rest of society that result from privatization. The average privatized firm is contributing $57 million more to taxes, meaning that the additional revenues that resulted from privatization would have been enough to give $212,727 to each of the 550 laid-off workers from the average firm.

Higher markups for consumers are not a big factor in profitability gains, since the mean increase in the firms prices compared to the producers price index is only 4.14 percent, accounting only for about 5 percent in the increase in profitability. Firms do not simply increase their markups following privatization. Instead, they undergo a radical restructuring process. Deregulation appears to complement privatization, prompting firms to restructure for increased competitiveness.

But the question remains whether privatization can only reap profits through layoffs and wage cuts. Here, our analysis of the data was sometimes though not always counterintuitive. Wages actually increased substantially in the firms in the sample for which data are available. The mean average annual real wage (i.e. discounting for inflation) was $4,815 in the pre-privatization period and rose to $8,500 in 1993. Interestingly, gains were larger for blue-collar workers than for white-collar workers: the mean blue-collar real wage rose from $3,067 to $7,090, and the mean white-collar real wage from $8,978 to $13,990. These large increases in real wages are all the more striking given the stagnation of real wages in the overall economy during the sample period.

We also discovered that there is no evidence that pre-privatization wages exceeded market levels as a result of income redistribution or of policies to cure failures in the labor market. Our research shows that jobs in state-owned companies were coveted because they required little effort and not because they paid well. After privatization, employers shed excess labor and increased wages of retained employees in exchange for increased worker effort.

To estimate the savings due to layoffs, our study looked at the counterfactual questions of how much lower profits would have been if all laid-off workers had been retained at their old wage. As it turns out, the savings are small relative to the layoffs, for two reasons. Wages tend to be low in Mexico. Total wages were equal to less than a quarter of sales in the pre-privatization period. And after the privatization, labor costs were spread over a much wider base, since sales increased rapidly an average of 60 percent. The mean savings from layoffs were equal to 6.88 percent of sales in 1993, indicating that savings due to layoffs account for about a third of profitability.

Overall, the evidence shows that close to two-thirds of the gains come from the restructuring of the firms and the efficiency gains in production. In the worse case scenario, layoffs assuming that workers laid off were rehired and did nothing can account at most for 33 percent of the higher profits, while price hikes for only 5 percent. The growth in output and the reductions in costs are very striking. Most firms, in both the competitive and noncompetitive sectors achieve their higher profits by restructuring their operations and increasing their efficiency.

The examination of data for Mexican privatized firms shows that the dramatic increase in output and improvements in performance of privatized firms seems to offset the possible costs to society.

Fall 1999

Florencio López de Silanes is Associate Professor of Public Policy at the Kennedy School of Government. He specializes in Financial Markets, Corporate Law Reform, Privatization and Deregulation. He has served as an advisor to the Peruvian, Mexican, Russian, Malaysian, Egyptian, and Yemenian governments on issues of privatization, deregulation, corporate and bankruptcy law, industrial policy and financial regulation. He has also been a Senior Economic Advisor to the Ministry of Industry and Trade in Mexico and a Consultant to the Ministry of Finance and the Ministry of Communications and Transportation in issues of privatization.

Related Articles

Poverty or Potential?

Teresa stops me three blocks from Nueva Imperial’s main plaza on a quiet Wednesday morning, eager to chat. She is wearing a light blue sweater and a matching blue headband glowing slightly against her dark black hair.

Infections and Inequalities

I read Paul Farmer’s book while on a short visit to Venezuela, and found that setting, at this historical moment in time, particularly pertinent and highly conducive to the arguments Farmer…

Proclaiming the Jubilee

Carmen Rodríguez heads the Charismatic Movement in a sprawling shantytown parish south of Lima, Peru. She and other lay leaders of the Lurín Diocese have been preparing for the…