Biomedical Exports and Costa Rica

The Great Reallocation of Global Supply Chains

What was Costa Rica’s greatest source of export revenue in 2023? If you guessed coffee, pineapple or bananas, you’re wrong. Medical devices—ranging from surgical and therapeutic devices to diagnostic equipment—lead the list of exports.

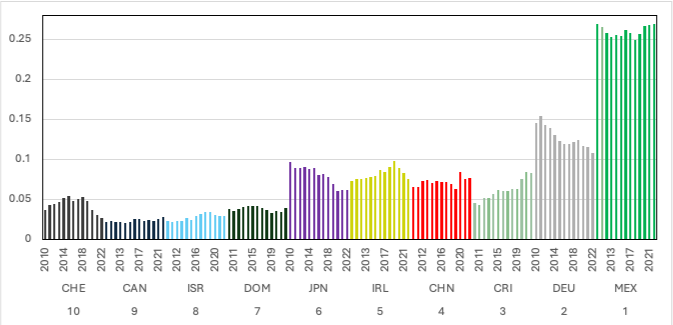

This burgeoning segment has taken center stage in the country’s export narrative. Costa Rica’s exports shine brightly: among Latin American countries, only Mexico exported more medical devices and related products to the United States. Remarkably, in 2022, Costa Rica’s exports outpaced China’s exports to the United States, highlighting its significant ascent in the international trade landscape and the reallocation of global value chains.

Costa Rica firmly positioned itself as an emerging titan within the biomedical exports sector, with medical device manufacturing leading the charge with a remarkable array of products, painting a vibrant picture of the country’s export capabilities. The nation’s ascension to a pivotal role in the global medical device market underscored a strategic embrace of the life sciences and MedTech sectors in the country’s export strategy. Behind this impressive surge lies a confluence of factors: a proficient and skilled labor force, a stable political climate and an attractive investment proposition, all of which have coalesced to reinforce Costa Rica’s standing as a key player in the global medical device market. The current geopolitical landscape as an oasis of stability in an often convulsed region has further contributed favorably.

As you may know from your visit to a local grocery store, products are not always as available as they used to be. The Covid-19 pandemic, natural disasters and climate change, as well as tthe US-China trade conflict and geopolitical upheavals created unprecedented tests for global supply chains. Amid these challenges, a reevaluation of global value chains is happening, reflecting a growing skepticism toward globalization in many developed countries. Many in the United States express concerns over trade and supply chain connections with China, as documented in Alfaro, Chen, and Chor (2023). Recent policies, including tariffs, trade restrictions, and subsidies, have been justified by the goal of mitigating risks by encouraging the reshoring, nearshoring and “friend-shoring” of supply chains, as U.S. Treasury Secretary Janet Yellen pointed out in 2022. This shift towards nearshoring/friend-shoring has played in Costa Rica’s favor, enhancing its position as an attractive hub for international trade. The country is witnessing a surge in firms eager to tap into its export economy, leveraging Costa Rica’s strategic location and trade-friendly policies to secure a spot in the evolving global commerce landscape.

We’ve noted significant shifts in recent global supply chain dynamics, especially in the United States, from geopolitical and natural crises (Alfaro and Chor, 2023). However, there’s no sign of deglobalization yet: U.S. imports, including those from China, reached new highs in 2022. The trends suggest not a retreat from global trade but a strategic “great reallocation” of U.S. sourcing. Despite China’s U.S. export growth, its market share dropped by about five percentage points, favoring Asian countries like Vietnam. North American Free Trade Agreement (NAFTA) members Canada and Mexico have emerged stronger, underscoring a shift towards regional value chains and friend-shoring, nearshoring, and reshoring.

Costa Rica, too, has carved out its advantage in this evolving trade landscape, especially in the medical devices sector, where it shines as a key player. The United States, being Costa Rica’s foremost trading partner in this domain, has seen over $300 million USD in bilateral trade, spotlighting the deep economic ties between the two nations in this sector. As Costa Rica continues to develop its medical tourism industry, the demand for high-quality and reliable medical equipment—much of which is sourced from the United States—is increasingly vital, further entwining the economic fortunes of these two countries in the realm of healthcare and medical technology. If someone travels from Nebraska to San José for dental work, for example, they expect to find top-notch equipment (the Tourism Ministry has indicated that six to eight percent of all tourism is for medical reasons).

Costa Rica’s impressive shift from an agriculture-based economy to one focused on manufacturing and its subsequent rise in the medical device manufacturing sector can be credited to a combination of pivotal factors. A skilled workforce, a stable political climate, and appealing investment incentives have played crucial roles in this transformation. These elements have strengthened Costa Rica’s economy and positioned it as an influential force in the global medical device market. The nation’s successful integration into global value chains underscores this achievement, highlighting how strategic moves and conducive conditions have facilitated its economic evolution and prominence on the world stage.

During the region’s import substitution model, associated with forming the Central American Common Market, foreign investment in the region was predominantly directed towards textiles, food and beverages, and light manufacturing. However, the debt crisis of the 1980s marked a pivotal shift away from import substitution towards an export-oriented development strategy. In response, Central American nations implemented various initiatives to attract investment and encourage the export of non-traditional products. A significant change in attitude towards Foreign Direct Investment (FDI) emerged, with FDI now regarded as a vital catalyst for economic growth and job creation. Costa Rica, in particular, embraced the “Zonas Francas” (free trade zones) approach, waiving customs duties and providing tax incentives to companies establishing export-driven manufacturing operations. Costa Rica further liberalized its trade policies and entered into both bilateral and multilateral free trade agreements. This move was part of a broader strategy adopted by several developing economies to stimulate economic expansion through global trade.

Costa Rica, reacting early to the limits of the textile and clothing industries, emerged as the leader in product diversification, attracting firms in intermediate- and high-technology sectors. To support this shift, the government launched educational programs for training new exporters in addition to tax and credit incentives and invested in upgrades to the national airport, ports, and customs systems to enhance international trade infrastructure. Additionally, Costa Rica established several pivotal institutions to support its trade and investment ambitions, including PROCOMER (the Export Promotion Agency), CINDE (the Investment Promotion Agency), MINEX (the Ministry of Foreign Trade), and CADEXCO (the Chamber of Costa Rican Exporters).

This period also marked the beginning of Costa Rica’s economic shift towards more sophisticated sectors, with the establishment of advanced manufacturing operations under the Zona Franca legislation. As Deborah Spar has observed, CINDE, the Costa Rican investment promotion agency, explicitly decided in the late 1980s to shift out of textiles—as Costa Rican wage levels rose and competition from lower-wage emerging markets mounted—and to concentrate instead on electronics. Foreign direct investment (FDI) flows became the country’s constant source of foreign capital. Foreign companies responded by investing in intermediate- and high-technology sectors. This diversification led to notable exports of medical equipment. communications equipment, and hair dryers, indicating the country’s successful transition to high-tech exports and highlighting the activities of various companies involved in these advanced sectors. By 1996, the export-processing zones were home to 192 companies, creating 25,500 jobs, an increase from 21,500 in 1994, and offered working conditions—including salaries, norms, safety, and health services—that were on par with on better than those outside the zones.

In 1996, marking a pivotal shift for the era, Intel Corporation announced its plans to build a semiconductor assembly plant in Costa Rica. It began to produce semiconductors in 1998. It was a game-changer for the country, amounting to six times the annual foreign direct investment (FDI) it had ever seen. Intel’s move was a significant economic boost and emblematic of the country’s desire and broader ambition to transition from traditional industries like textiles and clothing to more sophisticated manufacturing and service sectors. This strategic goal aimed to foster development through technological advancements, knowledge transfer, and the creation of linkages and synergies between foreign and domestic companies, setting a new course for Costa Rica’s economic landscape services to boost development efforts.

In 2014, Intel unveiled plans to reorganize its operations in Costa Rica, maintaining its Global Services Center and Engineering and Design Center within the country. These units will increasingly focus on Research & Development (R&D) activities, highlighting their growing importance in Intel’s innovation efforts, boasting a workforce of more than 1,200 people. Intel originally invested in Costa Rica during the 1990s to spread out its offices in different locations. With the recent pressures on global supply chains, the value of being geographically close to the United States has been reemphasized, leading Intel to reaffirm its commitment to Costa Rica and its strategic positioning. Intel’s choice in the 90s to expand into Costa Rica marked the expansion of FDI in electronics, medical devices and business services, attracting major companies, including Boston Scientific, Hewlett Packard, IBM and Procter & Gamble.

Boston Scientific‘s presence in Costa Rica is a compelling illustration of the country’s and company’s expansive journey. Boston Scientific began to operate in Costa Rica in 2004, its 25th anniversary, by opening its first facility in Heredia, primarily focusing on producing endoscopic devices. Founded on June 29, 1979, in Watertown, Massachusetts, Boston Scientific began as a holding company for Medi-Tech, Inc., a venture that dates back to 1969. The origin story of Medi-Tech is deeply rooted in the innovative spirit of Itzhak Bentov, an Israeli American inventor who survived the Holocaust by fleeing Czechoslovakia for the United States. Bentov, largely self-educated and a pioneer in the biomedical engineering field, invented a groundbreaking steerable, remotely controlled catheter in 1969. This invention, crafted in the basement of a Catholic church in Belmont, Massachusetts, was in response to the needs of a radiologist and a gastroenterologist at Boston Beth Israel Hospital.

The potential of Bentov’s invention caught the eye of John Abele, who recognized the opportunity to develop a range of products within the nascent field of “interventional medicine.”

Abele, alongside Pete Nicholas, sought investors to scale the enterprise, driven by Nicholas’s vision and desire to build a “significant business.” Their efforts turned Medi-Tech’s initial innovation into the cornerstone of Boston Scientific. Under the leadership of Abele and Nicholas, the company expanded its product offerings and international footprint through strategic acquisitions, leading to its official incorporation as Boston Scientific in 1988. A landmark moment in the company’s history was its initial public offering (IPO) in 1992, which saw the launch of 23.5 million shares on the New York Stock Exchange. This pivotal event not only underscored the company’s financial growth but also solidified its stature within the medical products industry, transforming it from a humble startup to a dominant force in the global market for medical devices.

In the mid-90s, Costa Rica strategically focused on the medical devices industry, leveraging its tax incentives to attract multinational corporations. Throughout this development period, CINDE has been a significant driving force, continuing its mission to attract medical device multinationals, bring jobs to the region and increase the sophistication of Costa Rica’s product and process offerings.

By 2009, Boston Scientific’s establishment of a new facility in Coyol set a precedent, making it the first medical device company in Costa Rica to operate out of two locations. Anabel González, the Minister of Foreign Trade at the time, recognized the significance of this milestone for the country, stating, “Boston Scientific has become a leading company contributing to our medical device sector growth. Its Heredia facility expansion is excellent news and will help increase our country’s participation in this important sector.” CINDE General Director Gabriela Llobet echoed this sentiment, remarking, “The expansion of Boston Scientific in Costa Rica, most recently in Heredia, has become a success story that allows us to constantly promote our country to other companies. Its strong performance confirms Costa Rica as an ideal location from which industry leaders can operate.”

As the company grew, it ventured into manufacturing increasingly complex and innovative medical devices. The year 2012 saw the inception of its Research and Development (R&D) center in Costa Rica with a modest initial team of five engineers, which has since grown to become the country’s premier R&D facility. By 2019, Boston Scientific further expanded its footprint in Costa Rica by opening a commercial office in San José, tasked with overseeing the entire Central American market. This strategic move placed the company at the forefront of marketing its products in Costa Rica, aligning with its commitment to direct patient care, a core value of Boston Scientific. After the company acquired Baylis Medical in 2022, it inaugurated operational site in Cartago the following year, positioning Boston Scientific as the first company to have three manufacturing facilities in Costa Rica. That same year, the announcement of an additional site in Cartago underscored the company’s ongoing expansion and commitment. Beyond manufacturing, Boston Scientific has diversified its operations to include shared services such as finance, IT and quality teams, further broadening its operational scope across various Costa Rican regions.

Boston Scientific’s significant footprint in Costa Rica enables the company to leverage extensive synergies across its operations. As the leading medical device employer in the country, within the largest industry, Boston Scientific garners substantial regional value. The company , reflecting its strong values and commitment to sustainability, achieved carbon neutrality in 2016, which resonates positively within the country’s values. Today, Boston Scientific’s enduring commitment to innovation and its leadership in interventional medicine underscores a legacy that continues to influence medical technology advancements. This story, especially its expansion into Costa Rica, highlights Boston Scientific’s strategic growth and its pivotal role in shaping the medical device industry.

Costa Rica is now home to more than 70 companies in the medical device field, including global giants like Baxter, Medtronic, Allergan, Hologic and Boston Scientific. Between 2014 and 2023, the sector enjoyed robust growth rates, showcasing its resilience and steady evolution Costa Rica’s medical device export sector has seen exceptional growth in recent years, highlighting its dynamic expansion. The precision devices, medical devices, and medical equipment sectors are leading the charge in the country’s exports. Moreover, Costa Rica’s export portfolio has expanded significantly, diversifying into various subcategories within precision products, medical devices and medical equipment. The range of precision products now includes components like precision-machined parts, optical lenses, electronic components such as microchips and circuit boards, precision tools and molded plastic components. The medical devices segment also includes orthopedic implants and surgical instruments, cardiovascular devices, diagnostic imaging equipment and disposable medical supplies. Additionally, the export of medical equipment has evolved to encompass a variety of products, including hospital beds, patient monitoring systems, surgical lights, anesthesia machines and medical refrigeration units. The increasing trend towards nearshoring has amplified its favorable position, attracting many companies to engage with Costa Rica’s export-driven economy. Despite the challenges and hurdles imposed by the pandemic, Costa Rica showcased exceptional resilience and growth within sectors characterized by their complexity, high-value nature and stringent regulatory standards.

The prospects for medical device manufacturing in Costa Rica remain bright. The country’s strategic location as a connector between North and South America provides manufacturers with direct access to both markets. Furthermore, Costa Rica’s commitment to an open economic policy, demonstrated by its engagement in 17 trade agreements with key global economies such as the United States and the European Union, significantly enhances the sector’s growth potential. Furthermore, the strategic partnership with the United States, where medical devices represent a significant portion of bilateral trade, emphasizes the crucial role of this sector in Costa Rica’s economic and export strategies, marking the country as a key player in the global medical device market.

The US-Costa Rica relationship has been mutually beneficial on multiple fronts, a fact that I have personally experienced. In the early 1960s, at the “request of President John F. Kennedy” and as part of the Alliance for Progress initiative, Harvard Business School Professor George Lodge (now emeritus), embarked on a project that led to the establishment of a business school, INCAE, initially in Nicaragua and subsequently in Costa Rica. This effort was supported by regional governments, the local business community and the U.S. Agency for International Development (USAID). This institution would later become the alma mater of my father, sister and brother, all of whom earned their MBAs there. During the economic challenges of the 1980s, USAID played a crucial role in facilitating structural reforms in Costa Rica, and, in the 90s, it funded my scholarship for Ph.D. studies at UCLA. My academic journey came full circle when I joined the faculty at Harvard Business School, where George Lodge served as both a mentor and collaborator on my first case study.

This narrative of cooperation and growth extends to Costa Rica’s strategic role in the United States’ nearshoring efforts. Decades of trade relations, shaped by initiatives and treaties from President Kennedy’s Alliance for Progress initiative, President Reagan’s Caribbean Basin Initiative to the CAFTA-DR agreement under President Bush, have fortified this partnership, showing the “benefits of trade that is free and fair,” as President Obama expressed in his visit. For Costa Rica, where the United States is the dominant trade partner, accounting for over 40% of exports and imports and serving as a major tourism source, these bonds are invaluable.

The shift towards reconfiguring global value chains and capitalizing on nearshoring opportunities has spotlighted the medical devices sector as a key driver of Costa Rica’s export growth, employment and economic development. Interestingly, this sector’s pioneering efforts can be traced back to an immigrant’s innovation near my current residence close to Boston, underscoring the interconnectedness of our global and local narratives.

Costa Rica is the oldest continuously functioning democracy in Latin America, with no army since 1949, which can serve “as a model of progress for Latin America and the Caribbean.” A country of virtually universal health and pensions, Costa Rica is the country in the region with the highest life span and, in many ways, a summary indicator of the quality of life and development progress. Costa Rica has shown a strong commitment to preserving the environment. The country is home to six percent of the world’s biodiversity, and 25 percent of the territory is classified as a national park or reserve. Costa Rica has emerged as a “global leader,” pioneering initiatives such as the “Payments for Environmental Services (PES) program,” which was initiated under President Figueres in the nineties. This program promotes conservation and has allowed the country to reverse deforestation. Costa Rica’s accomplishments are founded on a deep commitment to democracy, political stability, social welfare, respect for the environment and an “outward-oriented strategy based on openness to foreign investment and trade.

It leads globally in environmental conservation, highlighted by the innovative Payments for Environmental Services (PES) program initiated in the nineties s under President José Figueres, which significantly contributed to reversing deforestation trends. This synergy between Costa Rica’s intrinsic values and its economic ambitions underscores the country’s role as a model for progress, leveraging its longstanding partnership with the United States to foster growth in cutting-edge sectors.

The foundation of Costa Rica’s success in medical device manufacturing is multi-faceted and reflects a broader trend of nearshoring and the strategic realignment of global value chains. As the world navigates the complexities of the 21st century, Costa Rica’s journey offers valuable insights into how small nations can leverage their strengths to impact the global stage significantly. The story of Costa Rica’s rise in medical device manufacturing is not just about economic metrics; it’s about a nation’s relentless pursuit of progress, innovation and a better future for its people and the world at large.

Laura Alfaro is the Warren Alpert Professor of Business Administration at Harvard Business School (HBS). At Harvard since 1999, she served as Minister of National Planning and Economic Policy in Costa Rica from 2010-2012, taking a leave from HBS.

She thanks Gabriela Hernández for her help with this article.

Related Articles

Homecoming and Public Education: The Cancel Culture of (class time) in Costa Rica

When I returned home on my sabbatical, I couldn’t stop thinking about Svetlana Boym’s extraordinary book, El futuro de la nostalgia.

Crisis of Citizen Insecurity in Costa Rica: A Challenge to the Model of Demilitarized Democracy

I began my political and public service career thirty years ago as Minister of Public Security, the first woman to ever hold that post in my country, Costa Rica.

Editor’s Letter: Is Costa Rica Different?

Is Costa Rica different?