Peruvian Oil Production

Challenges and Opportunities

Solar energy in high-altitude Arequipa, Peru, is captured through steel and other metal. Photo by Renzo Nuñes/Ojos Propios.

The petroleum sector I know best is Peru’s, where I recently served as Minister of Energy and Mines. Because of the recent drop in prices, oil-producing countries are starting to adjust their contracts and review the sector regulation in order to protect their investments. In Peru the necessary changes have not been made, and there’s a risk production will continue to decline.

The need for adjustments extends far beyond a matter of investments though. It affects the possibility of accessing new technologies to protect the environment and of fair consultations with indigenous and other communities. And if low prices spur low production, the very existence of a pipeline to get oil to markets may be threatened.

In 2014, Peru was slowly starting to reverse its declining production, but the drop in oil prices has had a strong impact. The country had been producing some 200,000 barrels of oil daily in 1980, but the lack of investment and unsuccessful exploration investments had caused a decline. By 2013, Peru was producing only 63,000 barrels a day.

The exception in this downward spiral has been the development of natural gas deposits. Concentrated in the area of Camisea, gas has enabled Peru to enjoy secure, clean and low-cost energy since 2004.

Before the last trimester of 2014, everyone thought oil production would increase. Forecasts indicated that 2015 would end up with a production of 72,000 barrels daily and reach 150,000 by 2020. But now, plans to develop small deposits of petroleum discovered in the northern jungle region are being postponed.

Current production is 58,000 barrels daily—a block less than anticipated. And it’s feared that the Northern Oil Pipeline may have to close because of a lack of crude oil. What has happened? What can be done to reverse a situation that will have a negative impact on Peru’s balance of payments and future investments?

I’d like to focus here on oil production in the northern and central jungle areas, leaving aside other regions, including Camisea’s gas production. And I’d like to propose some steps to avoid declining production and to allow profits (the difference between world price for crude oil production and total costs of local production) to keep on benefiting the country on the national and regional levels, as well as business.

Many oil-producing countries are responding to the drop in oil prices through changes in contracts, particularly those signed for the more risky investments. These measures include deadline extensions for the exploratory phase, reductions in discount rates and royalties, and accelerated depreciation. However, a counter cost to these changes would be compliance with increasingly strict environmental standards and with social policies to commit more resources to benefit the neighboring communities.

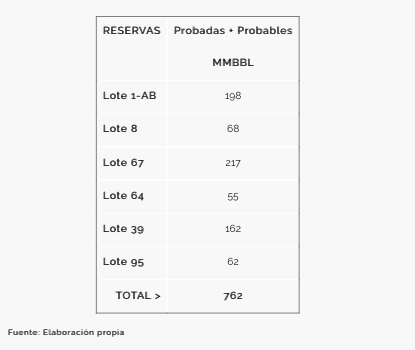

RESERVES IN THE NORTHERN AND CENTRAL JUNGLES

The northern and central jungle regions have a potential of likely reserves in relatively small fields of 20 to 30 million barrels. None of these reserves could alone sustain the construction of a new oil pipeline: the success of oil operations in this region depends on the continuity of service of the Northern Oil Pipeline.

Strategic allies need to elaborate a plan that will develop these oil fields so as to profit each operator, allowing production to increase in the short run and to maximize the recuperation and value of assets in the medium- and long-term.

IMPACTED PROJECTS

Perenco, a French company associated with PetroVietnam, has stopped work in blocks 67 and 39 until oil prices go up. Its production costs—including transportation on barges of an essential dissolvent from the Gulf of Mexico and the cost of moving its own oil production to the first station of the pipeline—do not permit it to continue operations until the price of oil approaches US$70 per barrel. Perenco had plans to produce up to 60,000 barrels daily, but now limits its production to 1,000 barrels a day, which is sent by river to the refinery in Manaus, Brazil.

A Canadian company, Gran Tierra, has decided to sell its block 95 because of the fall in oil prices and disappointing explorations of a second well. In January 2014, the company estimated that the block had 61.5 million barrels of proven and probable reserves.

Another company affected by the drop in oil prices is CEPSA, a Spanish firm controlled by the International Petroleum Investment Company of Abu Dhabi. Together with the Canadian company Pacific Rubiales, which has 30% of the project, it operates block 131, which depends on the oil pipeline to get its production to the market. At the end of 2014, CEPSA began production in one well, and encouraging tests from it justified sinking two more wells. CEPSA has confirmed a small deposit capable of producing between 5,000 to 8,000 barrels daily. PETROPERU has been the major purchaser of this production. If the oil pipeline ceases to function, the production will have nowhere to go.

The Argentine firm Pluspetrol has also experienced a severe drop in production. At the end of the 1990s, its block 8 was producing between 25 and 30,000 barrels a day; now—because of lack of investment and the intrusion of water—it only produces 8,500 barrels daily. Pluspetrol’s block 1AB, now reconfigured as block 192, is currently under bid. Once it produced 100,000 barrels of oil daily; now it produces only 10,000. The accumulated production of oil for this block is 716 million barrels. Yet this block holds the country’s greatest oil reserves. With its contract scheduled to end in August 2015, its production was evaluated for investment. Development of the proved reserves would increase production to 25,000 barrels daily in 2023, a figure that could be even greater if other reserves are discovered.

Even with low oil prices and the cost of importing the necessary dissolvent, this block provides royalties higher than 25%. Its potential encompasses proved developed reserves of 70 million barrels and an undeveloped potential of 90 million barrels, figures that justify a new 30-year concession. Oil wells with both heavy and light crude oil will permit the block to reach 28 million barrels a day by 2030. This scenario would include the development of the Chonta and Vivian reservoirs with exploration to determine if they hold sufficient amounts of light crude to compensate for the dissolvent imports.

For this all to work, the current bidding must be successfully concluded. However, a revision of the terms published by PERUPETRO, the oil regulatory agency, is worrisome:

• The deadline to present offers is quite short. The block has a number of fields in different areas, and a fairly complex infrastructure operating for years. Only those who have worked on this block (PLUSPETROL in particular) and have knowledge on the ground are in a position to present sensible offers; the rest of the companies might have to raise their offers.

• Another problem is the existence of payments for assets, as shown on the books. They are no longer realistic, given the low oil prices. Even if the price becomes effective after the second year and can be paid in installments, it still represents a significant burden in cash flow.

• Moreover, relations with the indigenous community have been fraught, and it has been difficult to implement the agreements made before the bidding process begins. The role of the Peruvian state in regards to PLUSPETROL, which has headed the operation for the last 30 years, and the ineffective way of their handling of agreements with the communities, can bring production stoppages and high costs for any company that starts up activities in this block.

• The option for a 25% participation of PETROPERU still up in the air, adds to the uncertainty. It would seem inconsistent for the board of directors to vote in the affirmative on a project with such environmental and economic challenges after turning down simpler and less risky projects. Anywhere else, the participation of the state would be welcome in order to facilitate the relations with the indigenous communities.

• The sequence of decisions that have to be made after a contract is signed doesn’t leave time for research on how to improve the engineering practices for this block. To rate the offers only on the basis of who will provide the best royalties or the greatest number of wells leaves out consideration of the time and effort needed to research new technologies.

There is a risk of a further drop in production because of a delay in the bidding process or because the new operator does not have the necessary experience and needs more time to begin operations. In that case, production could go down to 8,000 to 9,000 barrels daily, creating a situation of very high tariffs and endangering the minimum production needed to operate the pipeline.

The operation of the pipeline depends on the volume transported and the tariffs charged. If the current formula is applied, there will be a significant increase in tariffs. The question is how to avoid the paralysis of the pipeline and how to increase production in line with the geological potential of the region.

RECOMMENDATIONS

a) The most pressing need is to maintain or if possible reduce the pipeline tariff, eliminating fixed costs such as depreciation and to reduce the discount rate from 12 to 6%, which ought to be the cost of the capital of PETROPERU. This measure would reduce the tariff during the current crisis period, but later there should be a period of recovery so as not to affect the economy of PETROPERU.

b) In the medium term, production must be increased through cooperation between all the companies involved. Otherwise each will face the problem of economies of scale in the costs of dissolvent and transportation. PERUPETRO, the government regulatory agency, should call up a working group that can coordinate realistic goals for oil production. As PETROPERU operates the pipeline and the Iquitos refinery, it should be part of this group independently of whether it participates in the operation of block 192.

c) I recommend contacting Petroamazonas, Ecuador’s state oil company, which has signed new contracts to explore neighboring blocks of the border of Peru. The company must be approached because its production could generate the operating base needed by the pipeline.

d) CEPSA must receive incentives to elevate its production to 8,000 barrels daily to increase the amount of dissolvent available in the region.

e) The new operator of block 192 will play a crucial part in Peru’s oil panorama. The bidding rules on this block should be revised because they will determine production in the near future. Combined with the drop in oil prices, a fall in oil production will generate a recession with high social costs for this region of the country.

La producción de petróleo en la Selva Norte y Central

Retos y oportunidades

Por Eleodoro Mayorga Alba

La energía solar en Arequipa, Peru, se obtiene a través del acero y otro metal. Foto por Renzo Nuñes/Ojos Propios.

La baja del precio del crudo obliga a los países productores a ajustar sus contratos y las regulaciones del sector de manera a preservar la inversión. En el Perú, no se han dado aún los cambios requeridos y se corre el riesgo de que la producción continúe a declinar.

INTRODUCCIÓN

La producción de petróleo en el Perú, que durante el año 2014 comenzó a revertir su tendencia declinante, ha sufrido un fuerte impacto con la caída de los precios del crudo. Perú llegó a producir en 1980 hasta 200 mil barriles por día (MBD). La falta de inversiones y el poco éxito exploratorio han causado que la producción decline, para promediar 63 MBD en el 2013. La excepción de esta evolución ha sido la puesta en producción en el 2004 de los yacimientos de gas – condensados del área de Camisea que ha permitido que Perú en la última década goce de energía segura, limpia y de bajo costo.

La producción – antes del último trimestre del 2014 – estaba pronosticada aumentar. Se esperaba cerrar el 2015 encima de 72 MBD y llegar a 150 MBD al 2020. Notablemente, las inversiones para desarrollar los pequeños yacimientos de petróleo descubiertos en la Selva Norte están siendo postergadas.

La producción a la fecha es de 58 MBD y se corre el riesgo por falta de crudo de tener que cerrar el Oleoducto Nor Peruano (ONP). Qué ha sucedido? Qué podría hacerse para revertir esta situación que va a impactar negativamente la balanza comercial del país y las futuras inversiones.

Esta Nota trata los aspectos ligados a la producción de petróleo en la Selva Norte y Central, dejando aparte la producción de Camisea, y de otras regiones. La Nota propone decisiones para evitar la declinación de la producción y permitir que las rentas del sector sigan beneficiando al Gobierno Central, a las empresas, y a los Gobiernos Regionales.

Muchos países petroleros están respondiendo a la caída de los precios con cambios en sus contratos que permitan retener la inversión, sobre todo aquella de riesgo. Estos cambios incluyen extensiones en los plazos de la fase exploración, reducción de tasas de descuento y regalías, depreciaciones aceleradas, entre otras. Los cambios sin embargo no incluyen modificaciones en estándares ambientales cada vez más exigentes y en políticas de relacionamiento social que obligan a las empresas a comprometer recursos más significativos en sus proyectos a beneficio de las comunidades vecinas.

RESERVAS REMANENTES EN LA SELVA NORTE Y CENTRAL

Esta región dispone de una potencial de reservas probables en campos relativamente pequeños, es decir con reservas recuperables de 20 a 30 millones de barriles. Ninguno de ellos podría sustentar la construcción de un nuevo oleoducto; de ahí que el éxito de las operaciones depende de la continuidad del servicio del ONP.

Se requiere de una estrategia que integre, a través de alianzas estratégicas, el desarrollo estos campos bajo un esquema que eleve los beneficios de cada operador permitiendo incrementar la producción en el corto plazo y maximizar la recuperación y el valor de los activos en el mediano y largo plazo.

PROYECTOS IMPACTADOS

A – Perenco – empresa franco-vietnamita – ha parado su proyecto en los Lotes 67 y 39 a la espera de una mejora del precio del petróleo. Su costo de producción, basado en el transporte por barcazas tanto de un diluyente (nafta del Golfo de México) como de la producción hasta la estación inicial del ONP, no le permite continuar a menos que el barril se estabilice encima de 70 USD. Perenco que tenía planes para producir hasta 60 MBD ha limitado su producción a 1 MBD a ser evacuados por rio a la Refinería de Manaos.

B – Gran Tierra – empresa canadiense – confirmó en Enero 2014 las reservas del campo Bretaña del Lote 95, lote que ARCO operó en los años 70. En base a los resultados de una evaluación independiente, Gran Tierra reportó que el campo tiene 61.5 millones de barriles de reservas probadas y probables, y 113.9 millones sumando las reservas posibles. Sin embargo, con la caída de precios y los resultados poco alentadores de su segundo pozo, Gran Tierra ha puesto a la venta su proyecto.

C – CEPSA, empresa española controlada por el Fondo IPIC de Abu Dhabi, opera el Lote 131 con un 70% de participación, mientras que Pacific Rubiales detiene el 30%. Este Lote pertenece a la Cuenca Ucayali, pero para evacuar su producción requiere del ONP. CEPSA inició a finales del 2014 la producción del pozo descubridor Los Ángeles-1X cuyas pruebas fueron alentadoras justificando la perforación de dos pozos más. Con ello CEPSA ha confirmado un pequeño yacimiento capaz de producir 5 MBD de un crudo de 45o API que podrían aumentar hasta 8 MBD. PETROPERU ha sido el primer comprador de esta producción.

D – Lote 8 operado por la empresa argentina Pluspetrol – A fines de los 90 este Lote producía entre 25 y 30 MBD de un crudo de buena calidad (Maynas). Por falta de inversión y la intrusión del agua de formación, actualmente produce 8.5 MBD. El crecimiento de la demanda regional, dominado por diésel, y la falta de crudos apropiados, hacen que este petróleo se procese íntegramente en la Refinería de Iquitos.

E – Lote 1AB – operado también por Pluspétrol, cuyo contrato termina en Agosto 2015, está siendo licitado, reconfigurado como Lote 192. La producción acumulada de este Lote ha sido de 716 MMbbl. A fines de los 70, la producción superó los 100 MBD; hoy produce 10 MBD.

Este Lote posee las mayores reservas del país. A raíz de la terminación del contrato se ha evaluado la producción bajo distintos escenarios de inversión. Así, el sólo desarrollo de las reservas probadas permitiría elevar el régimen actual hasta un pico de cerca de 25 MBPD en el 2023, que podría ampliarse si se confirman reservas adicionales.

Los escenarios estudiados tienen una economía positiva. Aun con precios bajos, y la importación de diluyente, el Lote soporta regalías superiores al 25%. Su potencial comprende reservas probadas desarrolladas de 70 MMBbl y un potencial no desarrollado de 90MMBbl, con las cuales se justifica una nueva concesión por 30 años. Pozos de extensión tanto en los campos de crudo liviano, como en campos de crudo pesado, permitirían alcanzar 28 MBD al 2030.

El escenario que involucraría el desarrollo integral de los reservorios Chonta y Vivian, con perforaciones de exploración y confirmación requiere de estudios más profundos que permitan determinen los volúmenes de hidrocarburos livianos que sustituirían la compra de diluyente.

De crítica importancia es concluir exitosamente la licitación en curso. Una revisión de las bases publicadas por PERUPETRO deja sin embargo ciertas preocupaciones:

· El plazo para presentar ofertas es muy corto. El Lote tiene un buen número de pozos en campos relativamente diferentes y una infraestructura de producción con un buen número de años relativamente compleja. Solo aquellos que han trabajado en el Lote (PLUSPETROL en especial) y tienen información actualizada podrán presentar ofertas justificadas; el resto de empresas van a tener que cubrirse aumentando sus ofertas.

·La existencia de un pago por la propiedad de activos, estimado según su valor en libros, que no podría implementarse con los bajos precios. Aun si el pago comienza a ser efectivo desde el segundo año y puede fraccionarse, representa una carga significativa en el análisis del flujo de caja del ofertante.

·El difícil manejo de las relaciones con las comunidades indígenas, con cuyas federaciones no ha sido fácil concluir los acuerdos que han precedido a la licitación. El rol del Estado en relación a Pluspetrol, la empresa que ha estado al frente de la operación por 30 años, y la manera como se han venido llevando adelante los acuerdos con las comunidades pueden traer consigo paradas de producción de alto costo para cualquier empresa que se inicia en este Lote.

·La opción de participación de 25% a favor de PETROPERU sobre la cual no se conoce la decisión que tome el Directorio de PETROPERU agrega incertidumbre. Pareciera difícil e inconsistente que luego de haberse desechado participar en proyectos más sencillos y con menor riesgo – como en los Lotes 3, 4, 6 y 7- esta vez el Directorio decida en un Lote con mayores riesgos económicos y ambientales ejercer su opción. La participación de la empresa estatal en cualquier otro escenario sería bienvenida para facilitar la relación con las comunidades indígenas.

· La secuencia de decisiones a tomarse después de la firma del contrato no deja tiempo a ningún trabajo de investigación con miras a mejorar las prácticas de ingeniería de producción en este Lote. Calificar las ofertas en base a mayores regalías o al mayor número de pozos ofertados no deja espacio ni tiempo a la investigación de nuevas tecnologías que mejoren la recuperación final de las reservas de este Lote.

El riesgo de una caída suplementaria de producción persiste, a causa de un retraso en la licitación o porque el nuevo operador no cuenta con experiencia y necesita un plazo adicional para iniciar las operaciones. Como tal, la producción podría bajar hasta 8 – 9 MBD creando una situación de tarifas muy elevadas y poniendo en peligro los volúmenes mínimos para operar el ONP.

LA OPERACIÓN DEL ONP

El gráfico presenta los volúmenes transportados desde el 2007 y las tarifas cobradas. El volumen pronosticado para el 2015 de 18.329 MBD incluye: (i) que Perenco transporte su producción (1 MBD) por el ONP, lo que está en duda; y (ii) que el excedente de productos de la Refinería de Iquitos se incremente gracias a la compra del crudo de CEPSA.

Si aplicamos la fórmula vigente[1] habría un aumento significativo de las tarifas. La pregunta es cómo evitar una paralización del servicio del Oleoducto, y como aumentar la producción a niveles que correspondan al potencial geológico de la región.

RECOMENDACIONES

a) Lo inmediato es bajar la tarifa eliminando los costos fijos (depreciación), y la tasa de descuento de 12 a 6 % que debe ser el costo de capital que tiene PETROPERU. Esta medida implicaría una baja de la tarifa durante el periodo de crisis actual, que luego debe tener un periodo de recuperación para no afectar la economía de PETROPERU.

b) En el mediano plazo, es necesario elevar la producción, para ello hay que buscar una coordinación efectiva entre las empresas involucradas. Solas, cada una tendrá el problema de la falta de economías de escala para bajar los costos del suministro de diluyente como de evacuación de su producción. PERUPETRO está llamado a liderar un grupo de trabajo que coordine metas realistas de producción por campo. PETROPERÚ también tiene un rol como operador del Oleoducto y de la Refinería de Iquitos, al margen de si entra o no a participar en la operación del Lote 192.

c) Contactar a Petroamazonas, empresa estatal del Ecuador, que ha firmado nuevos contratos para explorar lotes vecinos a la frontera, incluyendo el proyecto ITT. Esta producción podría generar la base operativa estable que el ONP necesita.

d) Incentivar a CEPSA para que eleve su producción a 8 MBD de manera a aumentar el diluyente disponible en la región.

e) Pero el jugará un papel central será el nuevo operador del Lote 192. Se debe revisar las bases para la licitación de este Lote puesto que sus implicaciones serán determinantes sobre la producción a mediano plazo. Combinada a la baja de los precios, una caída de la producción generara una recesión de alto costo social en esta región del país.

Fall 2015, Volume XV, Number 1

Eleodoro Mayorga Alba is the former Peruvian Minister of Energy and Mines; he is a petroleum engineer with a doctorate in economics, with more than 40 years of experience negotiating contracts and consulting with governments in the hydrocarbon sector. He can be reached at emayorgaalba@gmail.com

Eleodoro Mayorga Alba – Ex – Ministro de Energía y Minas; Ingeniero de Petróleo y Doctor en Economía, con más de 40 años en la negociación de contratos y el asesoramiento de gobiernos en políticas del sector hidrocarburos. E-mail: emayorgaalba@gmail.com

Related Articles

Oil and Indigenous Communities

On a drizzly morning in late February, a boat full of silent Kukama men motored slowly into the flooded forest off the Marañón River in northern Peru. Cutting the…

Mexico’s Energy Reform

The small, white-washed classroom at the University in Minatitlán, Veracruz, was packed with a couple dozen people who, although neighbors, had never met…

Geothermal Energy in Central America

When we think about global technology leaders, Central America does not typically come to mind. But Central American countries have indeed been in the…