Making a Difference: A Look at Microfinance

I spent ten months working for Natik, a small non-profit organization that supports grassroots organizations around San Cristóbal de las Casas and Santiago Atitlán, Guatemala. One of these projects is a microfinance fund called Veredas.

Over the past several years, academics, development professionals and grassroots activists have begun to voice concern about microfinance, arguing not only that it is not effective in fighting poverty, but that it can be harmful to clients and communities. Criticisms of microfinance range from critiques of how microfinance programs are implemented, including their high interest rates, the inability of their loan officers to effectively track their clients, and their exaggerated focus on profitability as well as more philosophical arguments that microfinance unfairly places the onus of development on individuals instead of on the state, and that the expectation that people in deep poverty become successful entrepreneurs is unrealistic.

San Cristóbal, like most of Chiapas, is full of microfinance institutions that vary greatly in terms of both financial success and commitment to the poor communities in which they work. Many charge very high interest rates and require that their clients take out large minimum first loans. Since its founding in 2009, Veredas has striven for a different model, providing loans to small cooperatives of women who make artisanal soaps, woven and embroidered textiles, and corn products. The loans are small by microfinance standards, and interest is symbolic, barely covering the cost of inflation. Most importantly, Veredas is committed to providing comprehensive “accompaniment” of every loan it disburses. This support can range from help filling out the loan application to input on product design, depending on the requests of each group.

Veredas hopes that this small, non-profit model of microfinance can provide insight into how microfinance can work better. By focusing services on women who already work together, Veredas avoids creating an expectation that every poor person become an entrepreneur. Interviews with program participants suggest that this vintage model of microfinance may have real positive effects. Participants report feeling more empowered in activities such as managing their own finances.

As part of Veredas’ commitment to providing services that respond to the goals and needs of the cooperatives, other Natik staff members and I visited loan recipients frequently to get to know them and track their progress. When we asked, “What aspects of your business would you like help with?” participants overwhelmingly asked us to help them sell more of their products. Unfortunately, the market for artisanal products is saturated in San Cristóbal and fluctuates seasonally. Despite their skill, creativity, and attention to detail, cooperatives receiving Veredas loans have difficulty selling their crafts. Thus, I worked with Natik to help artisans in one textile cooperative market their products on Etsy, a burgeoning online crafts marketplace. There, the cooperative can reach a wider audience and charge slightly higher prices for their items. In order to relieve the pressure of packaging, shipping and marketing from the artisans who already have so much to do, Natik relies on an extensive network of volunteers throughout the U.S. to receive bulk shipments from the artisans, post them to the site, and respond to orders and inquiries.

The Etsy project began in January 2013 and is currently in the process of evaluating its first year of operation. In one year, the project has resulted in more than US$1200 of revenue for a small cooperative that feels the benefit of every extra dollar raised. Sales increased steadily over the course of the year, and the site now also includes products from a Guatemalan artisan’s cooperative supported by Natik. In the coming year, Natik plans to streamline the project to make it as sustainable as possible and seriously evaluate its results with significant input from the cooperatives. Microfinance is a complicated project, but we hope that through intentional program design and hard work to expand the opportunities available to participants, we can create a model worth taking seriously.

Winter 2014, Volume XIII, Number 2

Jason Dyett is the Program Director of the DRCLAS Brazil Office.

Related Articles

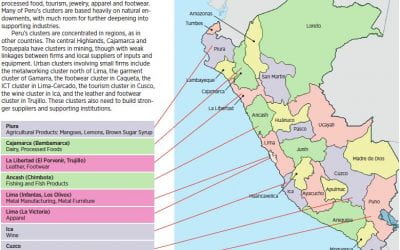

Towards a National Value Proposition

Peru has been one of the most remarkable economic growth stories of the last decade, both compared to its own historic record and to its peers in Latin America and beyond. A combination of sound macroeconomic policies since the mid-1990s and a benevolent international economic environment with growing demand for Peru’s natural resources has allowed the country to prosper.

A Taste of Lima

Each one of us has a grandmother or mother, grandfather or father whose dish—humble or elaborate—transports us back in time or space, surrounds us with people, places, images, languages, and even fragrances of the past. The dish—or the memory of the dish—evokes a smile, or perhaps a tear, and generally seems inimitable by those who share the memory.

Seeking Progress in Twentieth-Century Peru

The year was 1993. My wife Barbara and I had just arrived in Lima, with the intention of working there for two or three years. I had a job in a USAID project, while my wife was part of a World Bank planning group in the Ministry of Education. Peru was just recovering from staggering blows, both economic and political.