Chinese Development Finance and the Andean Amazon Infrastructure Boom

While diplomatic tensions simmer between the U.S. government and its counterparts in Latin America and in China, the South Americans have been growing closer to the Chinese, particularly in the area of development finance. Six South American nations (Argentina, Bolivia, Brazil, Chile, Ecuador and Venezuela) have applied for membership in the Asian Infrastructure Investment Bank, and China has also invited Latin American and Caribbean (LAC) countries to join the “Belt and Road Initiative” of infrastructure links between Asia and the world. This coming year, the Inter-American Development Bank (IDB) will hold its annual meeting in China.

China’s Expanding Presence in Andean Amazonian Infrastructure

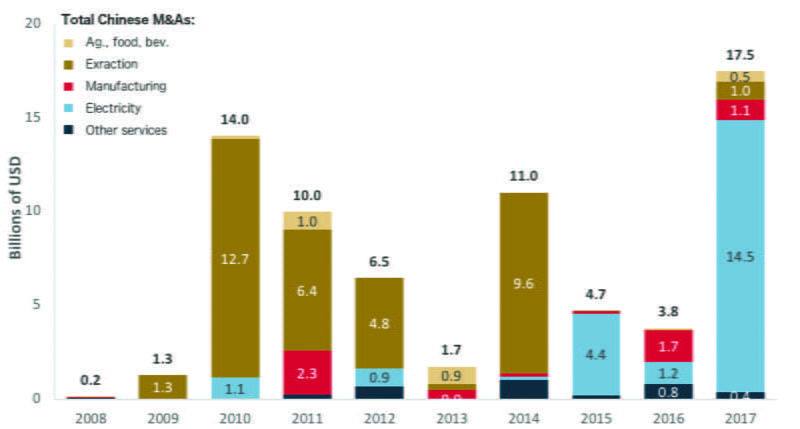

China’s presence in LAC has not only been growing in size but also shifting from a focus on extracting raw materials toward financing infrastructure necessary to produce and transport them. Figure 1 shows the last decade of Chinese merger and acquisition investment in LAC. While the first several years were focused on extraction, electricity generation and distribution have dominated more recently.

see FIGURE 1

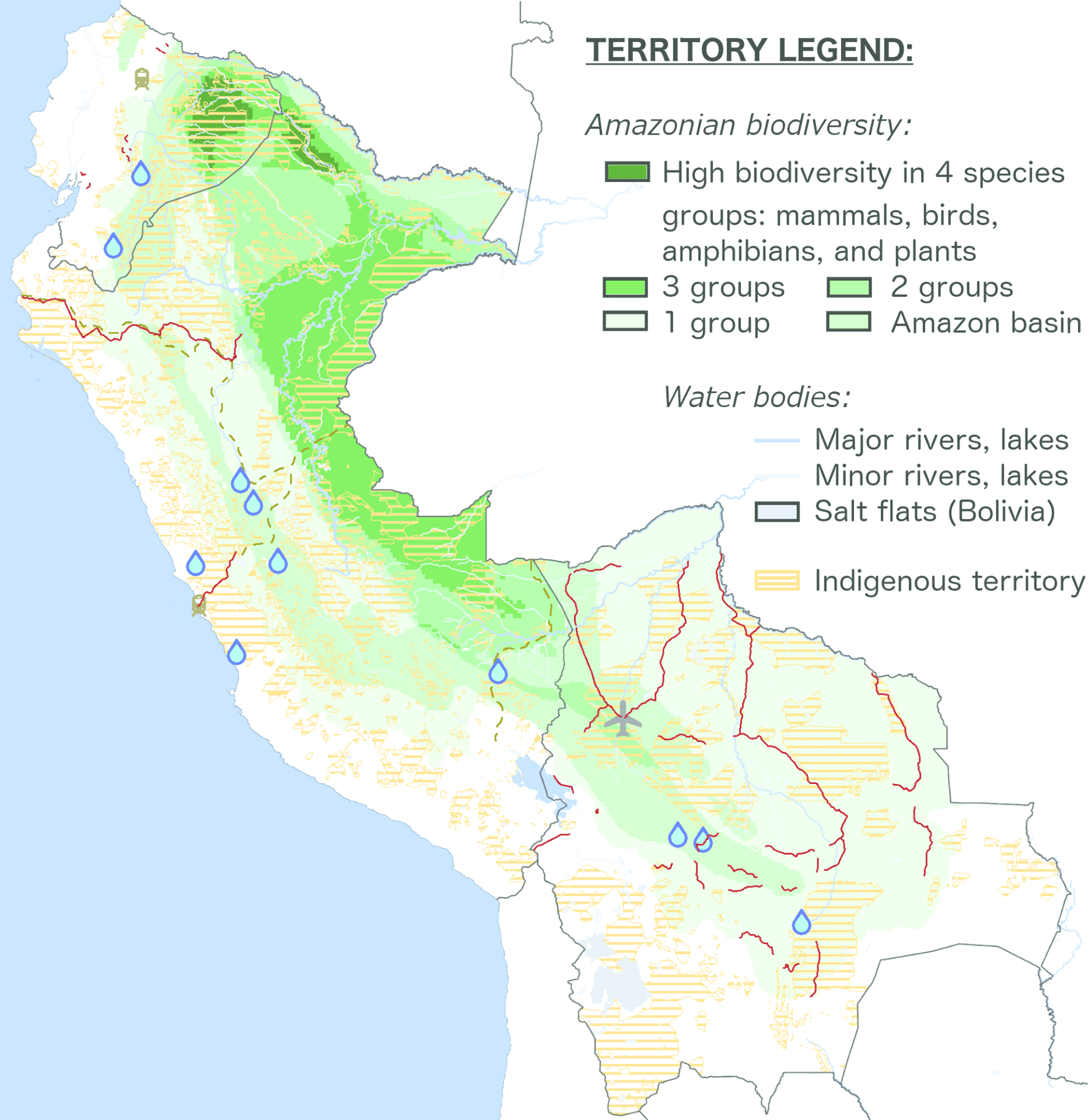

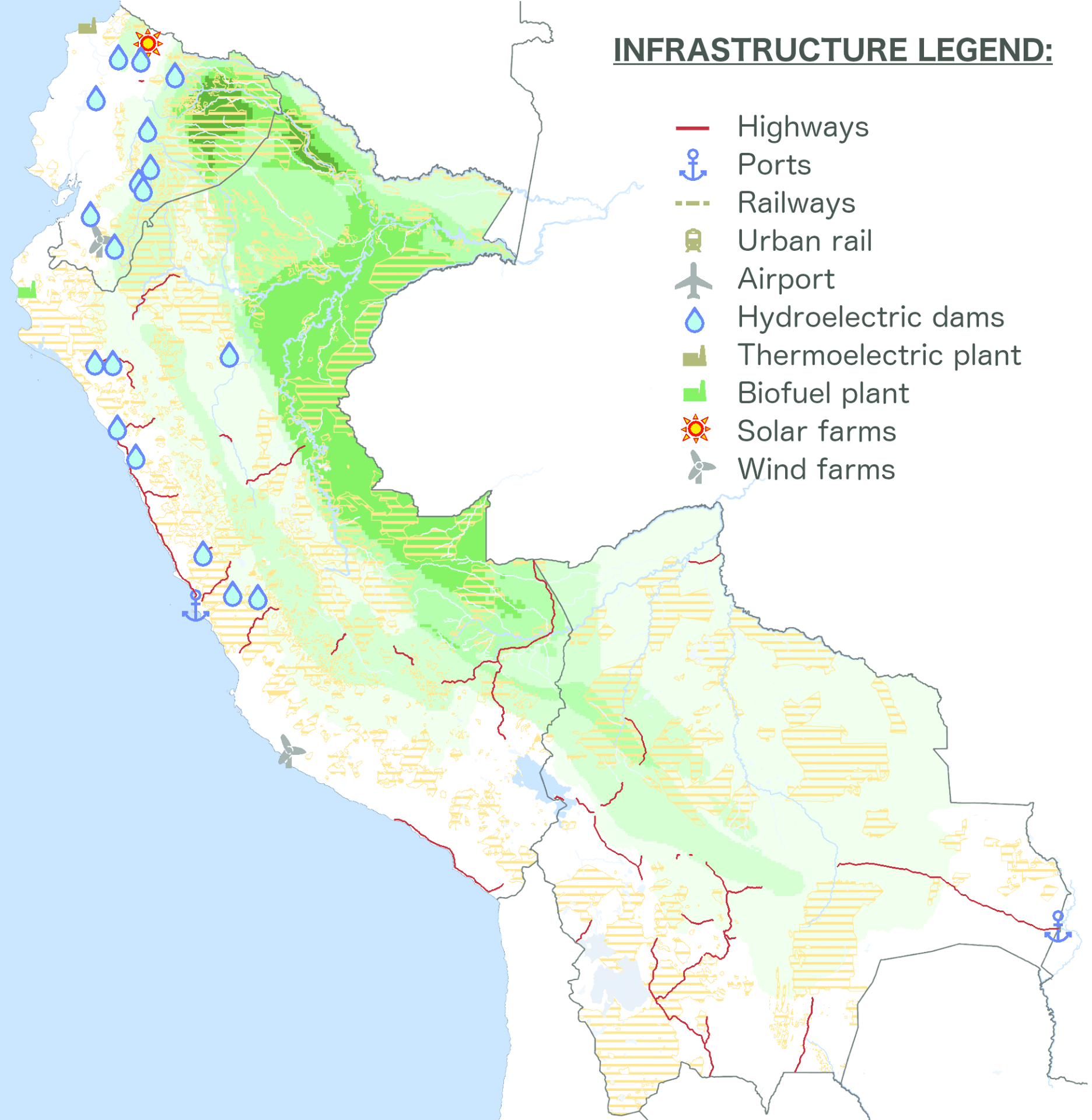

China’s shift toward LAC infrastructure finance comes as the Andean Amazon—the western Amazon basin and central Andean highlands of Ecuador, Peru, and Bolivia—is experiencing an infrastructure boom with help from international development finance institutions (DFIs). This region is particularly challenging for infrastructure planning, as it boasts the richest biodiversity in the hemisphere as well as the “uncontacted frontier”—the highest concentration of voluntarily isolated and uncontacted indigenous communities on earth. Figure 2 shows international DFI-financed infrastructure projects approved and completed between 2000 and 2015, compared to new projects and those still in the pipeline. The last 15 years saw 64 projects completed, including many hydropower dams along the edge of the Amazon basin and in the Andean highlands. Since then, 58 new projects have already been completed or approved, and they are expanding further into the Amazon basin itself. The Andean Amazon is at a crucial juncture for determining how this unfolding infrastructure boom will unfold.

FIGURE 2: International DFI-Financed Infrastructure Projects in Ecuador, Peru, and Bolivia. Completed Projects, 2000-2015 New and Pipeline Projects Source: Rebecca Ray, Kevin Gallagher, and Cynthia Sanborn. (2018). “Standardizing Sustainable Development? Development Banks in the Andean Amazon” Boston University.

see FIGURE 2

Chinese policy banks—the China Development Bank and the Export-Import Bank of China—play major roles in this expansion. As Figure 3 shows, Chinese DFI infrastructure finance in the Amazon basin is growing quickly. While Chinese DFIs accounted for fewer than one in 10 projects between 2000 and 2015, they are financing one-fourth of new projects—and one-third of those in the Amazon basin itself.

see FIGURE 3

Chinese DFIs’ passive ESRM approach is not without benefits. Their lack of formal safeguards accelerates their approvals, avoiding what Chris Humphrey calls the “hassle factor” of traditional development finance. The World Bank’s new Environmental and Social Framework may partly address these delays by relying on borrowers’ “country systems” of assessment and monitoring. Nonetheless, at present the World Bank and IDB both face significant disadvantages in this regard: Humphrey has calculated that IDB approval takes an average of 5.8 months and World Bank projects in LAC take 14 months (“The ‘‘Hassle Factor” of MDB Lending and Borrower Demand in Latin America.” In S. Park & J. Strand (Eds.), Global Economic Governance and the Development Practices of the Multilateral Development Banks. London: Routledge).

Despite these advantages, Chinese DFIs’ deferential ESRM framework may attract projects that have failed to pass other DFIs’ safeguards processes – or which pose enough risk to make traditional DFI financing time-consuming or potentially impossible. DFIs do not regularly publish their rejections, so it is unknown which Chinese-financed infrastructure projects have been rejected elsewhere. However, bank records show that planners for some of the region’s largest flagship projects – such as Ecuador’s Coca-Codo Sinclair dam – sought Chinese financing only after years of seeking approval through DFIs with more active ESRM approaches.

ESRM in action: the case of Coca-Codo Sinclair

Over the last two years, Boston University’s Global Development Policy Center has partnered with colleagues at FLACSO Ecuador; Universidad del Pacífico in Lima, Peru; and INESAD in La Paz to explore the extent to which various approaches to ESRM contribute to project outcomes. Among the case studies examined was Coca-Codo Sinclair (CCS), Ecuador’s largest hydroelectric dam. CCS was financed by the Export-Import Bank of China (CHEXIM) and built by Sinohydro, though the project was previously considered by the Inter-American Development Bank (IDB). Across all six case studies in three countries, results show that three factors are crucial in mitigating environmental and social risks: stakeholder engagement; robust environmental impact assessments (EIAs); and transparency and accountability. (For more on this work, see Rebecca Ray, Kevin Gallagher, and Cynthia Sanborn. “Standardizing Sustainable Development? Development Banks in the Andean Amazon” Boston University, 2018.) CCS case study researchers (María Cristina Vallejo, Betty Espinoza, Francisco Venes, Víctor López, and Susana Anda) found major shortcomings in the project’s management in each of the crucial areas.

CCS sits among small, non-indigenous communities, which are not covered by Ecuador’s guarantee of prior consultation for indigenous nations. Instead, these communities had a socialización process in which project details were communicated and community concerns noted. Interviews with community members show a near-universal understanding that CCS promised ample employment for local workers and opportunities for local contracting of worker lodging. However, the lack of formal commitments meant that the community had little recourse when the contractor brought workers from another Sinohydro worksite in coastal Ecuador and housed them in a separate worker camp, leading to significant social conflict and numerous protests.

CCS’s environmental impact was assessed in two stages, corresponding to two loans: one for the dam and one for associated high-tension power lines. No comprehensive assessment of the entire project was performed, nor were cascading risks between the two project parts considered, as would have been required if it had received IDB financing. No catastrophic environmental problems have occurred yet but given the proximity of the active Reventador volcano and the prevalence of earthquakes in the area, this simplified EIA process may leave CHEXIM with unanticipated risks.

Finally, CCS’s full environmental impact is unknown, because of lagging transparency. Coca-Codo Sinclair was charged with performing its own environmental audits (an arrangement that presents serious conflicts of interest) but has not published them as required. Labor problems have also been exacerbated by inadequate accountability. Unsafe labor conditions prevailed during construction despite worker complaints, until after an outbreak of typhoid fever related to unsafe water, the deaths of 13 workers from a platform collapse, and eventually a worker strike. After that point, Labor Minister Francisco Vacas visited the site to spur a resolution; fieldwork interviews show that conditions improved thereafter. Ideally, an effective system of transparency and accountability would have entailed active project monitoring and evaluation, with the goal of preventing these instances of worker deaths, illnesses, and conflict.

Chinese policy banks’ deferential approach to ESRM enabled an ambitious project like CCS to be approved quickly and with few bureaucratic hurdles. But flagship projects like CCS stretch the need for monitoring beyond national institutions’ experience and create incentives to overlook due diligence to save time, save money, or save face. By establishing its own standards like the World Bank or IDB do, or by helping national institutions enforce their own standard like CAF does, CHEXIM could help prevent similar problems in future projects.

Discussion: Importance of Mutually-Reinforcing Networks

Despite these problems, our work suggests that bank safeguards alone cannot determine the environmental and social impacts of infrastructure projects. If that were the case, projects financed by DFIs with the most stringent standards – the World Bank and Inter-American Development Bank – would have universally positive outcomes, which did not emerge in any of the case studies.

Nor are strict national regulations sufficient, though governments ultimately oversee enforcement of social and environmental norms. Ecuador, Peru, and Bolivia’s standards are among the world’s most ambitious, covering indigenous consultation, labor rights, and liability for environmental damages. However, none of the case studies showed adequately implemented national standards.

Instead, this research shows that safeguards succeed or fall short depending on the strength of collaboration between banks and national authorities. Effective safeguard implementation appears to be associated with mutually-reinforcing networks of support from both sides. DFIs and national governments have similar – but not identical – project goals, and answer to different constituencies. Through collaboration in project oversight, they can ensure that a wider range of concerns is considered, and a broader array of resources harnessed to address them.

In the context of maximizing overall benefits, Chinese policy banks’ deferential approach to ESRM gives them a distinct disadvantage relative to other DFIs in the region. LAC’s burgeoning relationship with China has brought new partnerships and opportunities for development finance, but also new risks. Pursuing those opportunities while mitigating the risks will be crucial in ensuring a truly “win-win” relationship.

Rebecca Ray is a post-doctoral research fellow at the Boston University Global Development Policy Center. She holds a PhD in economics from the University of Massachusetts -Amherst and an MA in international development studies from the George Washington University Elliott School of International Affairs. She is the lead editor of China and Sustainable Development in Latin America: the Social and Environmental Dimension (Anthem Press, 2017).

Related Articles

Youth in Postwar Guatemala: Education and Civic Identity in Transition

What happens when young people must simultaneously grapple with an uncertain future burdened with the legacy of conflict, violence, and impunity? Michelle Bellino provides some answers to a question that echoes throughout many conflict-affected areas, Guatemala in…

Social Policy Expansion in Latin America

The welfare state emerged in middle-income countries in Latin America during the first half of the 20th century when health care services and pensions were granted to workers with formal sector jobs…

The Migrant Photography of Haruo Ohara

Japanese began migrating to Brazil 110 years ago, becoming probably the most prosperous minority group in Latin America and certainly the largest Nikkei community in the globe. In 2008,