Divine Decadence or Business Turnaround?

The Case of Venezuelan Chocolate

Photos courtesy of Jorge Redmond

Back in 2006, we became intrigued about a chocolate company in Venezuela. Rohit had done quite a bit of work on companies that were integrating country of origin into their product branding. He called it the Provenance Paradox. As Director of HBS’s Latin America Research Center, Gustavo had collaborated on some of Rohit’s research. There were the case studies of Chilean wine, Mexican beer and Colombian coffee. Gustavo had also worked on Peruvian gourmet cuisine, and Rohit’s coverage expanded well beyond Latin America into subjects such as Indian yoga, Japanese soy sauce, and even Turkish chocolate!.

Back in 2006, we became intrigued about a chocolate company in Venezuela. Rohit had done quite a bit of work on companies that were integrating country of origin into their product branding. He called it the Provenance Paradox. As Director of HBS’s Latin America Research Center, Gustavo had collaborated on some of Rohit’s research. There were the case studies of Chilean wine, Mexican beer and Colombian coffee. Gustavo had also worked on Peruvian gourmet cuisine, and Rohit’s coverage expanded well beyond Latin America into subjects such as Indian yoga, Japanese soy sauce, and even Turkish chocolate!.

Our interest in the Venezuelan company resulted in the teaching case Chocolates El Rey that we wrote with Regina García Cuellar, published by Harvard Business Publishing.

When we learned that ReVista was planning to focus its Fall 2020 issue on chocolate, we figured we could share our takeaways from writing the case. We learned that chocolate lends itself to multiple contexts, ranging from romantic aspirations to macro-economic impact. In the middle, there are nutritional, health, gourmet tasting and business aspects that make it an interesting subject on which to write.

A Market Overview

About 50 million people depend on cocoa production for their livelihood, according to the World Cocoa Foundation. The world production of cocoa was 4.78 million tons in 2019. Of this production, more than 75% of beans were grown in Africa, 18% in Central and South America and the Caribbean, and 6% in Asia and Oceania. Just two countries, Ivory Coast and Ghana, accounted for more than 60% of world production. Cocoa beans exports accounted for almost two-thirds of Ivory Coast’s exports.

But what is interesting is that a profound asymmetry exists between production and consumption. The leading producer countries do not account for the majority of consumption. More than 80% of the world’s cocoa beans are exported from developing nations to industrial countries where chocolate is manufactured. In a clear demonstration of the economic models that prevail with many commodities, value to transform raw materials is added in other countries. The largest importers of cocoa beans were from Europe and the United States: almost two-thirds of exports went into the Netherlands, Germany, the United States, Belgium, France, the United Kingdom and Switzerland. These countries, in turn, exported finished chocolate for $14.8 billion, roughly half of a $29.2 billion trade market. This finishing of the chocolate includes sweetening with sugar, diluting with milk, and of course the mass production processes of packaging and later branding, advertising and mass marketing.

Annual retail sales of chocolate add up to more than $90 billion, with Europe accounting for nearly half of that figure and the United States for over 20%. Chocolate consumption is believed to be a sign of economic development and wealth. Despite producing more than 75% of the world’s cocoa, African consumers only account for 3% of the chocolate that is consumed annually. It is hence unsurprising that most consumers of finished chocolate believe that cocoa originates in Europe, perhaps identifying Switzerland (because of Lindt) and Belgium (because of Godiva). Both of these large firms purchase raw material from other countries because cocoa, for instance, can only grow in the tropics.

Venezuelan Cocoa

With a population of 27.5 million people, Venezuela is the 14th largest producer of cocoa beans in the world. Located on the northern tip of South America, bordering the equator, Venezuela enjoys the same warmth and humidity that led to the origin of Kakau (cacao). Its criollo quality stems from the Theobroma cacao tree that grows in its terrain. Contrasted with the forastero quality, criollo is sweeter and less bitter. This makes Venezuelan cocoa highly prized in terms of quality. Cocoa bean quality is further determined by its shape, size, color, flavor and aroma. These attributes result from the quality of the terrain, climate and humidity of the site where it is grown, and to the fermentation and drying processes that follow. Venezuelan cacao has historically commanded a 30% price premium over cacao from other national origins in the world commodity market.

Venezuela’s Gross Domestic Product (GDP) plunged from $483 billion in 2015 to $180 billion in 2019, measured in International Dollars per 2011 PPP prices, because of political turmoil and lower international oil prices. Oil was the country’s largest source of national wealth, to the neglect of other products that used to be healthy contributors to its GDP. Oil got to account for more than 95% of Venezuelan exports and nearly half of the country’s government revenues. Following the crude oil WTI price (WTI, which stands for West Texas Intermediate, is a benchmark for global crude oil) drop from $145 per barrel in July 2008 to $51 in January 2009, Venezuela’s exports dropped from $95.9 billion in 2008 to $16.5 billion in 2019. President Hugo Chávez had expropriated hundreds of companies, including the largest telephone operator (CANTV) and the capital’s power generator (Electricidad de Caracas), discouraging private investment. Chávez died in 2013 and was succeeded by his appointed Vice-President Nicolás Maduro, who continued his policies. Chávez and Maduro are broadly viewed as representatives of an expression of 21st century socialism, along with other Latin American leaders such as Néstor and Cristina Kirchner of Argentina, Lula da Silva and Dilma Rousseff of Brazil, Rafael Correa of Ecuador and Evo Morales of Bolivia.

On January 23, 2019, the opposition-controlled National Assembly elected Juan Guaidó as the country’s acting President, alleging that Maduro’s 2018 reelection had been fraudulent. Venezuela added an institutional crisis to its already difficult situation: 60 countries, including the United States and most Western European and Latin American nations, recognized Guaidó as the country’s ruling president. The United States, Venezuela’s largest trading partner, instituted an embargo on oil imports, and froze Venezuelan assets, imposing further sanctions on Venezuelans who are known members of the Maduro regime. The Bank of England repeatedly denied Maduro’s access to 14 tonnes of gold reserves deposited in the United Kingdom.

In the meantime, cocoa beans accounted for just 0.3% of Venezuelan exports in 2019. A shocking revelation, considering Venezuela had been the world’s largest exporter of cocoa beans in the 17th century, with the beans becoming the largest export product for the country in the 1620s, a fact that remained true for the next two centuries.

According to historians and economists, Venezuela is suffering a typical “resource curse,” stemming from its predominant focus on a single commodity, to the detriment of other historical sources of revenues for the country. Such a resource curse is unfortunately not at all uncommon in developing countries, especially where the single commodity discovery has been oil. Politics, embargos and world oil prices deepen that curse.

Chocolates El Rey

Chocolates El Rey, founded in 1929, was Venezuela’s second-oldest chocolate company. In 2006 its president was Jorge Redmond, great-grandson of Pius Schlageter, who was responsible for providing the original loan that funded the company.

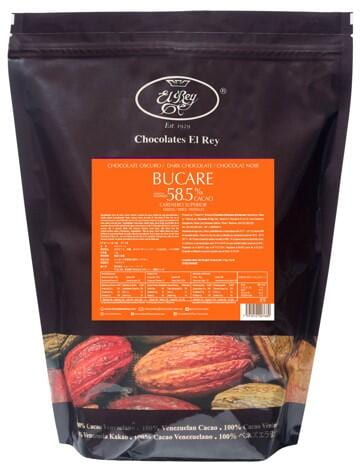

El Rey exported 27% of its production as an ingredient to foreign chocolate manufacturers. In the domestic market, it served four segments:

- Food Services. Chips, bars and discs sold through distributors for wholesale use to restaurants, bakeries, pastry shops and chocolatiers.

- Chocolate powder used to produce instant chocolate milk, sold to supermarkets, restaurants and bakeries.

- Tailor-made chocolate products used by manufacturers as raw material for products such as ice cream, chocolate chip cookies, and cereal frostings.

- Mostly bars and tablets, branded and unbranded, consumed as confectionery or raw material for cooking, sold through the same distributors that served the beverages market.

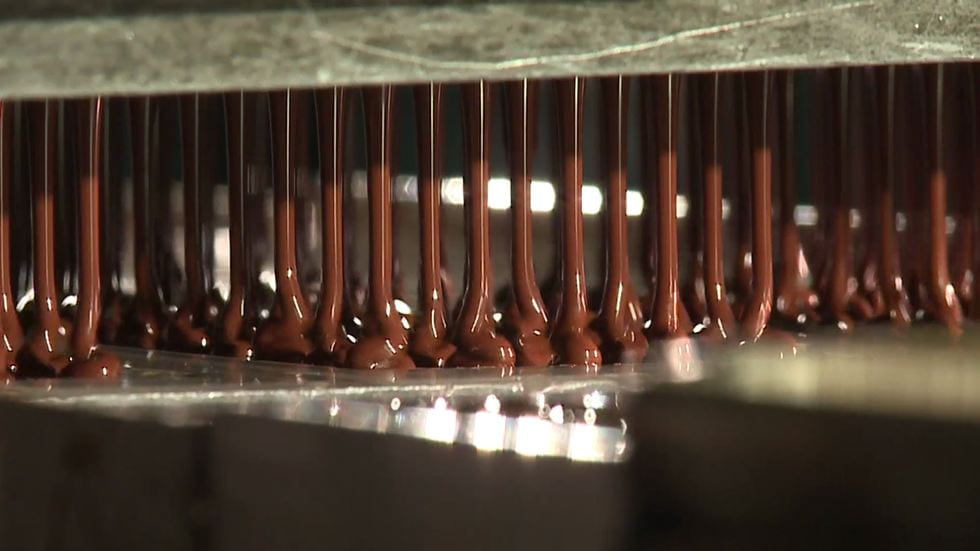

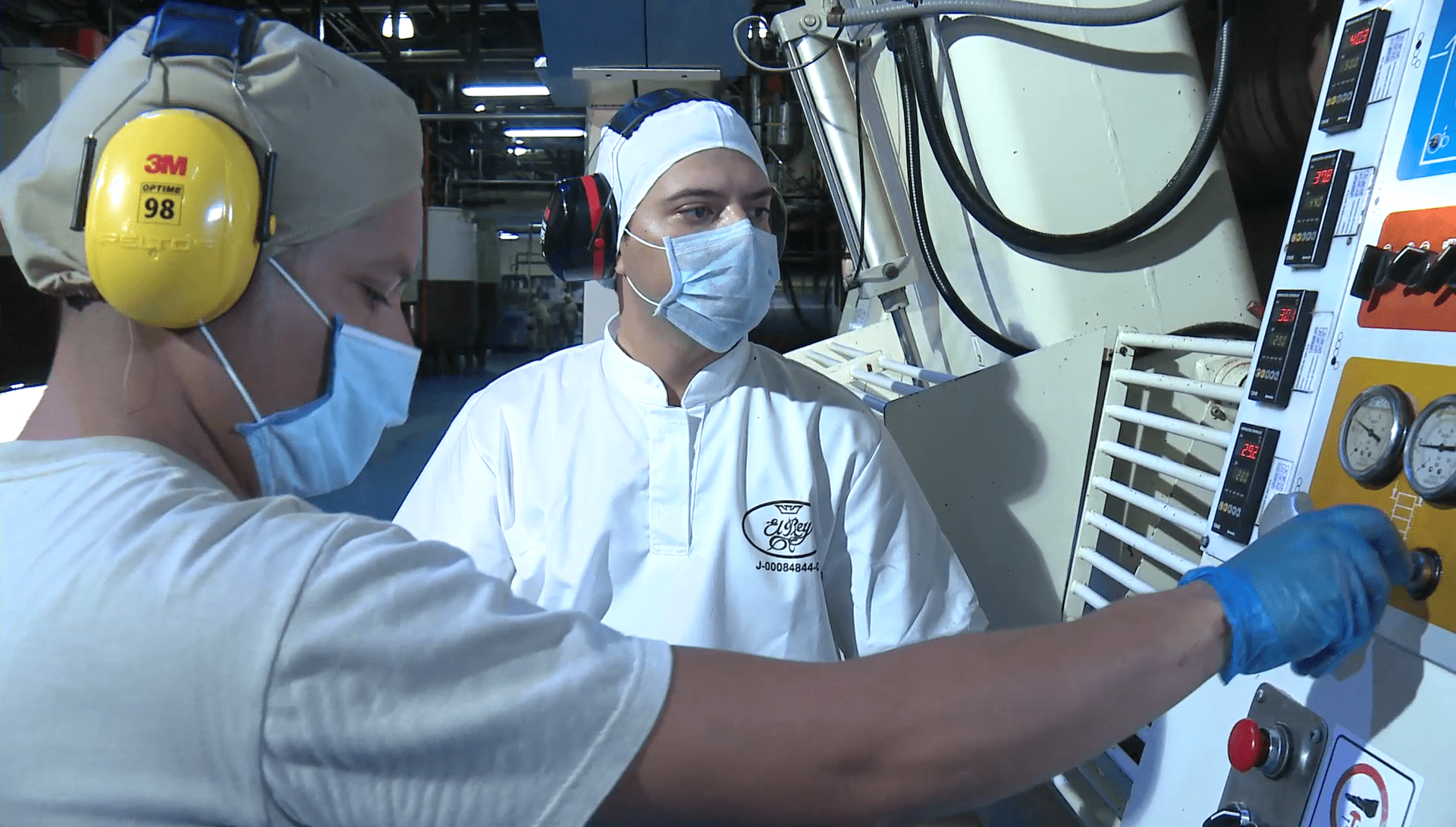

El Rey was a relatively small company, with sales of $13.6 million in 2006, processing 3,000 tons of chocolate. It was a well-known, established company, leveraging the quality of the Venezuelan cacao beans and its longstanding tradition. It developed the Cacao Route (Ruta de cacao), similar to country-of-origin tours created by other nations and regions to promote their natural products, such as wine, cheese and coffee. The Route convened international top chefs and gourmet-magazine writers, exposing them to cocoa haciendas where they could witness how the beans were planted, harvested and processed. Visits were complemented with folklore music and dancing, related to cocoa traditions. Visitors were then taken to El Rey’s Barquisimento plant, where El Rey chocolates were produced, to observe premium quality processes. The visit ended with a stay in Caracas, where chefs were taken to top chocolatiers who used El Rey’s products exclusively. The purpose of the Cacao Route was not just to sell El Rey chocolate but also to sell Venezuela, a country with exquisite cocoa beans production and extensive cultural traditions surrounding the cocoa harvest.

El Rey held dominant positions in the food services and industrial markets, serving as the main supplier for multinational firms that used chocolate in their product lines (such as. McDonald’s ice cream, Nabisco’s chocolate chip cookies, and Kellogg’s choco-muesli cereal). Its Taco 30% share of the chocolate powder market for instant beverage was second only to Nestlé’s Rock-o-late. It had also become the exclusive chocolate provider for Venezuela’s premium chefs and chocolatiers.

Jorge Redmond and El Rey’s management wished to grow their business and pondered different alternatives. The difficulties that characterized the Venezuelan business environment imposed restrictions on the availability of capital even then. In the late 1990s, El Rey had tried to integrate backwards into cocoa bean production in the late 1990s, investing in a hacienda called San Joaquín. This was an attempt to improve profitability through experimental accelerated bean production, but, according to Jorge Redmond ,the hacienda was occupied by Chávez supporters (pisatarios) and El Rey lost its investment.

After this frustrating experience with the San Joaquín hacienda, El Rey decided to stay out of cocoa bean production and concentrate on just chocolate production. Under El Rey’s leadership, 11 cocoa-processing companies came together under a not-for-profit organization called Aprocao, with the purpose of running a research institute that promoted best practices in cocoa bean production, furthering industry-government relations, and buying beans directly from producers that observed best practices in harvesting and processing. Aprocao bought 38% of the cocoa beans produced in the country. El Rey was the company that bought almost exclusively the more expensive and rarer fermented beans produced.

Consistent with their focus on chocolate production, in 2015 El Rey decided to increase its investment in its Barquisimento plant (inaugurated in 1995), integrating it backwards to process all of the beans it required, doubling its physical capacity at a cost of eight million dollars.

At the same time, El Rey decided to explore businesses that offered higher margins, especially in the exports market. By then, the company enjoyed a good reputation among chocolate manufacturers and chocolatiers abroad, especially in the United States, Europe and Japan. Accessing foreign revenues in Venezuela’s troubled environment was critical to achieve growth.

Fast-forward to 2019, Jorge Redmond found himself and his company in an even more frustrating situation. Sales in 2018 dropped to $1 million, with 820 tons processed. The investment in the Barquisimento plant was halted. Venezuela’s rampant inflation and devaluation liquidated the company’s working capital. Credit was unavailable, and the Venezuelan bolívar lost most of its purchasing power, leading to greater levels of poverty and unemployment in the country.

We spoke with Jorge Redmond at the time of this article. The Covid-19 pandemic has worsened the situation in Venezuela, posing yet higher hurdles to recovery. Yet, we found him to be in good spirits, fighting for survival, and planning to step up to the occasion when the situation improved. The equipment for the Barquisimento plant is already in the country, and El Rey’s product reputation is stellar. Foreign customers continue to value the company’s quality, and are willing to increase their purchases when they overcome their own pandemic effects and when buying from Venezuela regains reliability.

El Rey has presented to the government a Plan Cacao to increase Venezuela’s cocoa bean production from the 15,000 tons/year where it has been stagnant for the last 50 years to over 85,000 tons in a span of 15 years, with an investment of $350 million. Redmond affirms that there is interest from the Inter-American Development Bank (IDB) and from European funds to finance the project, when things get back to normal.

In the meantime, chocolate has kept its ascribed psychosocial properties, and dark chocolate gained further recognition over the years for its attributes to lower blood pressure, prevent memory decline, balance hormones and protect the body from stress. Recent reports state that the soothing effects of chocolate’s chemical components play a positive role in the Pandemic Era. Chocolate continues to enjoy its denomination as Food of the Gods ascribed to it by the Aztecs.

Time for another case?

¿Decadencia divina o reversión de un negocio?

El caso del chocolate venezolano

Por Rohit Deshpandé y Gustavo Herrero

Fotos cortesía de Jorge Redmond

En 2006, nos llamó la atención una empresa de chocolate en Venezuela. Rohit había investigado compañías que integraban el país de origen en las marcas de sus productos. Lo denominó la Paradoja de la Procedencia. En su rol de Director del Centro de Investigación de América Latina de la Escuela de Negocios de Harvard, Gustavo había colaborado con Rohit en parte de su investigación. Escribieron casos de vino chileno, cerveza mexicana y café colombiano. Gustavo también había trabajado un caso de cocina peruana, y la cobertura de Rohit se expande más allá de América Latina, con casos de yoga de India, salsa de soja japonesa, y hasta chocolate turco.

Nuestro interés en la empresa venezolana se materializó en el caso de enseñanza Chocolates El Rey que escribimos con Regina García Cuellar, y que fue publicado por Harvard Business Publishing.

Cuando nos enteramos que ReVista estaba considerando enfocar su número de Otoño 2020 en chocolate, pensamos que podríamos compartir las reflexiones que extrajimos de la escritura del caso. Aprendimos que el chocolate se presta a múltiples contextos, desde aspiraciones románticas hasta impacto macro-económico. En el medio, hay aspectos nutricionales, sanitarios, de degustación gourmet y de negocios, que lo convierten en un interesante tema sobre el cual escribir.

Panorama comercial

Alrededor de 50 millones de personas dependen de la producción de cacao para su subsistencia, según la Fundación Mundial de Cacao (World Cocoa Foundation.) La producción global de cacao fue de 4,78 millones de toneladas en 2019. De ese total, más del 75% se produjo en Africa, 18% en Sudámerica, América Central y el Caribe, y 6% en Asia y Oceanía. Sólo dos países, Costa de Marfil y Ghana, representaron más del 50% de la producción mundial. La exportación de cacao fue equivalente a casi dos tercios del total de exportaciones de Costa de Marfil.

Pero lo verdaderamente interesante es la profunda asimetría que existe entre la producción y el consumo. Los principales países productores no representan la mayor parte del consumo. Más del 80% del cacao se exporta de países en desarrollo a países industrializados que producen chocolate. En una clara demostración de lo que ocurre con modelos económicos que prevalecen para muchos commodities, el valor que transforma a las materias primas se agrega en otros países. Los principales importadores de cacao fueron de Europa y de Norteamérica: casi dos tercios de las exportaciones fueron a Holanda, Alemania, los Estados Unidos, Bélgica, Francia, el Reino Unido y Suiza. Estos países, a su vez, exportaron chocolate terminado por $14,8 billones (billones entendido en el uso estadounidense, no un mil milliones como en otros países), prácticamente la mitad de un negocio de intercambio comercial de $29,2 billones. El acabado del chocolate incluye el endulzamiento con azúcar, su dilución con leche, y por supuesto procesos masivos de empaque y luego marca, publicidad y marketing.

Las ventas anuales al menudeo suman más de $90 billones, siendo Europa responsable por cerca de la mitad de esa cifra, y los Estados Unidos por más del 20%. El consumo de chocolate se percibe como un signo de desarrollo económico y de riqueza. A pesar de producir más del 75% del cacao de todo el mundo, los africanos consumen solo el 3% del chocolate que se produce anualmente. Por lo tanto, no debería sorprender que la mayor parte de los consumidores de chocolate fino creen que el cacao se origina en Europa, quizás asociándolo con Suiza (por Lindt) y con Bélgica (por Godiva). Ambas firmas adquieren su material prima de otros países, dado que el cacao sólo crece en los trópicos.

Cacao venezolano

Con una población de 27,5 millones de habitantes, Venezuela es el 14º país productor de cacao del mundo. Ubicada en el borde septentrional de Sudamérica, vecina al ecuador, Venezuela disfruta de la misma temperatura y humedad que dieron origen al Kakau (cacao). Su calidad criollo proviene del árbol de cacao Theobroma que crece en su suelo. Contrastando con la calidad forastero, el criollo es más dulce y menos amargo. Eso hace que el cacao venezolano sea altamente valorizado por su calidad. La calidad del poroto de cacao también se determina por su forma, su tamaño, su color, su sabor y su aroma. Estos atributos de calidad provienen del suelo, de la lluvia, del clima y de la humedad del sitio donde crece, y de los procesos de fermentación y secado que le siguen. El cacao venezolano se ha valorizado históricamente con una plusvalía del 30% en los mercados internacionales, por encima del precio de cacao de otros países.

El Producto Bruto Interno (PBI) de Venezuela cayó de $483 billones en 2015 a $180 billones en 2019, medido en Dólares Internacionales de paridad de poder adquisitivo (PPP) de 2011, debido a turbulencias políticas y al derrumbe del precio del petróleo. El petróleo era la mayor fuente de riqueza del país, en desmedro de otros productos que solían ser saludables contribuyentes al PBI. Llegó a representar más del 95% de las exportaciones venezolanas, y casi la mitad de los ingresos del gobierno. Después de la caída del precio de petróleo crudo WTI (que proviene de West Texas Intermediate, un estándar de petróleo crudo a nivel mundial) de $145 el barril en Julio de 2008 a $51 en Enero de 2009, las exportaciones de Venezuela cayeron de $95,9 billones en 2008 a 16,5 billones en 2019. El Presidente Hugo Chávez había expropiado cientos de empresas, incluyendo a la mayor operadora de telefonía (CANTV) y a la generadora de electricidad de la capital (Electricidad de Caracas), desalentando la inversión privada. Chávez falleció en 2013 y lo sucedió su Vice-Presidente Nicolás Maduro, quien continuó con sus políticas. Chávez y Maduro son vistos como exponentes de la expresión de socialismo del siglo 21, junto a otros líderes latinoamericanos, como Néstor y Cristina Kirchner de Argentina, Lula da Silva y Dilma Rousseff de Brasil, Rafael Correa de Ecuador, y Evo Morales de Bolivia.

El 23 de Enero de 2019, la Asamblea Nacional, controlada por la oposición, eligió a Juan Guaidó como Presidente en ejercicio de Venezuela, alegando que la reelección de Maduro en 2018 había sido fraudulenta. Venezuela agregó una crisis institucional a su ya complicada situación: 60 países, incluyendo a Estados Unidos y a la mayor parte de las naciones europeas y latinoamericanas, reconocieron a Guaidó como legítimo Presidente. Estados Unidos, el principal socio comercial de Venezuela, implementó un embargo a las importaciones de petróleo venezolano y congeló los activos de Venezuela, imponiendo sanciones adicionales a miembros conocidos del régimen de Maduro. El Banco de Inglaterra negó acceso a Maduro a 14 toneladas de reservas de oro depositadas en el Reino Unido en repetidas oportunidades.

Mientras tanto, el cacao representó solo el 0,3% de las exportaciones de Venezuela en 2019. Una impactante revelación, considerando que Venezuela había sido el principal exportador de cacao del mundo en el siglo 17, habiéndose convertido el cacao en el principal producto exportado, un hecho que se mantuvo por los siguientes dos siglos.

De acuerdo a historiadores y economistas, Venezuela sufre de la clásica “maldición de recursos,” proveniente de su foco predominante en un solo producto, en desmedro de otras fuentes de ingresos históricamente existentes en el país. Dicha maldición de recursos lamentablemente no es atípica de otros países, especialmente cuando el producto predominante ha sido el petróleo. Acontecimientos políticos, embargos y la volatilidad del precio del petróleo profundizan ese efecto.

Chocolates El Rey

Chocolates El Rey, fundada en 1929, fue la segunda empresa de chocolate más antigua de Venezuela. En 2006 su presidente era Jorge Redmond, biznieto de Pius Schlageter, que fue quien proveyó la financiación que dio origen a la compañía.

El Rey exportaba el 27% de su producción, como insumo para fabricantes extranjeros de chocolate. En el mercado interno atendía cuatro segmentos:

- Servicios de Alimentación. Chips, barras y discos vendidos a través de distribuidores mayoristas a restaurants, panaderías, confiterías, y chocolatiers.

- Polvo de chocolate utilizado para producir leche chocolatada instantánea, vendido a supermercados, restaurantes y panaderías,

- Productos de chocolate hechos a pedido, utilizados como insumo por fabricantes de helados, galletas con chips de chocolate y cobertura de cereales.

- Mayormente barras y tabletas, con y sin marca, consumidas como golosinas o como ingredientes para cocina, vendidas a través de los mismos distribuidores que atendían el mercado de bebidas chocolatadas.

El Rey era una empresa relativamente chica, con ventas de $13,6 millones en 2006, procesando 3.000 toneladas de chocolate. Era una compañía conocida, bien establecida, que se basaba en la calidad del cacao venezolano y su longeva tradición. Desarrolló la Ruta de Cacao, similar a tours de país de origen creados por otras naciones y regiones para promover sus productos, tales como vinos, quesos y café. La Ruta convocaba a chefs internacionales y a periodistas de revistas gourmet, exponiéndolos a haciendas de cacao donde podían observar cómo el cacao se plantaba, se cosechaba y se procesaba. Las visitas se complementaban con música y bailes folklóricos, relacionados a las tradiciones del cacao. Luego los visitantes eran llevados a la planta de El Rey en Barquisimento donde se producían los chocolates, para observar los procesos de calidad superior. La visita finalizaba con una estadía en Caracas, donde los chefs eran llevados a chocolatiers que utilizaban productos de El Rey en exclusividad. El propósito de la Ruta del Cacao no era solamente vender el chocolate de El Rey sino también promover a Venezuela, un país con producción de exquisito cacao y de extensas tradiciones culturales ligadas a su cosecha.

El Rey tenía posiciones dominantes en los mercados de servicios de alimentos e industrial, siendo el principal proveedor de firmas multinacionales que utilizaban chocolate en sus líneas de productos (tales como el helado de McDonald, los chips de las galletas de Nabisco, y el cereal choco-muesli de Kellogg). La participación del 30% de su marca Taco en el mercado de chocolate en polvo para bebidas instantáneas era sólo inferior a la de la marca internacional Rock-o-late de Nestlé. También se había transformado en el proveedor exclusivo de los chefs y chocolatiers más reconocidos de Venezuela.

Jorge Redmond y el equipo de conducción de El Rey querían crecer su negocio y sopesaban diferentes alternativas. Las dificultades que caracterizaban al entorno de negocios de Venezuela imponían restricciones al acceso a capital aún en esa época. A fines de la década de 1990, El Rey había intentado integrarse verticalmente hacia la producción de cacao, invirtiendo en una hacienda llamada San Joaquín. Fue un intento de mejorar la rentabilidad del negocio a través de procesos de producción experimental acelerada de cacao, pero, según Jorge Redmond, la hacienda fue ocupada por adeptos de Chávez denominados pisatarios, y El Rey perdió su inversión.

Después de la frustrante experiencia con la hacienda San Joaquín, El Rey decidió apartarse de la producción de cacao y concentrarse en la producción de chocolate. Con el liderazgo de El Rey, 11 empresas procesadoras de cacao se unieron bajo una organización sin fin de lucro llamada Aprocao, con el objeto de crear un instituto de investigación que promovía buenas prácticas en la producción de cacao, desarrollaba relaciones de la industria con el gobierno, y adquiría cacao directamente de aquellos productores que observaban prácticas óptimas de cosecha y procesamiento. Aprocao compraba el 38% del cacao que se producía en el país. El Rey era la empresa que compraba casi exclusivamente el cacao de precio superior y de excepcional calidad de fermentación.

Consistente con su foco en la producción de chocolate, en 2015 El Rey decidió incrementar su inversión en la planta de Barquisimento (inaugurada en 1995), integrándose hacia el procesamiento de todo el cacao requerido por sus chocolates, duplicando su capacidad a un costo de ocho millones de dólares.

Simultáneamente, El Rey decidió explorar negocios que ofrecían márgenes superiores, especialmente en el mercado de exportación. Para entonces, la empresa gozaba de una buena reputación entre los fabricantes extranjeros de chocolate, especialmente en Estados Unidos, Europa y Japón. El acceso a ingresos del exterior en el complicado entorno de Venezuela era fundamental para lograr crecer.

Pasando rápidamente a 2019, encontramos a Jorge Redmond y a su empresa enfrentando una situación aún más frustrante. Las ventas habían caído a $1 millón en 2018, con 820 toneladas procesadas. La inversión en Barquisimento se había interrumpido. La enorme inflación y devaluación de Venezuela habían liquidado el capital de trabajo de la empresa. El crédito era inexistente y el Bolívar venezolano había perdido la mayor parte de su capacidad adquisitiva, llevando al país a niveles mayores de pobreza y de desempleo.

Hablamos con Jorge Redmond cuando nos abocamos a escribir este artículo. La pandemia COVID-19 ha agravado la situación en Venezuela, levantando barreras aún más altas para la recuperación. No obstante, lo encontramos con buen estado de ánimo, luchando para subsistir, y planificando aprovechar la oportunidad cuando la situación mejore. El equipamiento para Barquisimento ya está en el país, y la reputación del producto de El Rey es impecable. Clientes del exterior continúan valorando la empresa, y están dispuestos a incrementar sus compras cuando superen sus propios efectos de la pandemia y cuando Venezuela restablezca confianza en su credibilidad.

El Rey le presentó al gobierno un Plan Cacao para incrementar la producción de cacao de las 15,000 toneladas anuales donde se ha estancado en los últimos 50 años a 85,000 toneladas anuales en un lapso de 15 años, con una inversión de $350 millones. Redmond afirma que hay interés del Banco Interamericano de Desarrollo (BID) y de fondos europeos para financiar el proyecto cuando la situación se normalice.

Mientras tanto, el chocolate ha mantenido las propiedades psico-sociales que se le atribuyen, y el chocolate amargo ha ganado reconocimiento a lo largo de los años por sus efectos favorables para reducir la presión arterial, prevenir la pérdida de memoria, alcanzar equilibrio hormonal, y proteger al cuerpo de estrés. Reportes recientes manifiestan que el efecto tranquilizador de los componentes químicos del chocolate juegan un papel positivo ante la pandemia. El chocolate continúa haciendo honor a su denominación de Alimento de los Dioses, atribuida a los Aztecas.

¿Será hora de desarrollar otro caso?

Fall 2020, Volume XX, Number 1

Rohit Deshpandé is the Sebastian S. Kresge Professor of Marketing at the Harvard Business School. He earned his degree of Bachelor of Science from the University of Bombay, his MBA from Northwestern University’s Kellogg School of Management, and his Ph.D. from the University of Pittsburgh. Throughout his tenure at HBS, he has worked on various fields of study, such as Customer-Centric Marketing Strategy, on Workplace Ethics and Global Business Standards, and lately on Cultural Entrepreneurship and the Business of the Arts.

Gustavo Herrero graduated from Harvard Business School in 1976 and worked as a business executive in Argentina, Paraguay and the United States. He became the Executive Director of HBS’s Latin America Research Center in November 1999, a position he held until he retired in December 2013. He currently serves on the Advisory Committee of the David Rockefeller Center for Latin American Studies and on the HBS Latin American Advisory Board.

Rohit Deshpandé es Profesor Sebastian S. Kresge de Marketing en la Escuela de Negocios de Harvard. Obtuvo su título de Bachelor of Science de la Universidad de Bombay, su MBA de la Escuela de Negocios Kellogg de la Universidad Northwestern, y su PhD de la Universidad de Pittsburgh. Durante su carrera en HBS, ha trabajado en varias áreas de estudio, tales como Estrategias de Marketing centradas en los Clientes, Ética en el lugar de trabajo, Estándares Globales de Negocios, y últimamente en Emprendimiento Cultural en el Negocio de las Artes.

Gustavo Herrero se graduó de la Escuela de Negocios de Harvard en 1976 y trabajó como ejecutivo en Argentina, Paraguay y Estados Unidos. Asumió como Director Ejecutivo del Centro de Investigación para América Latina de HBS en Noviembre de 1999, posición que ocupó hasta su retiro en Diciembre de 2013. Actualmente se desempeña en el Comité Asesor del Centro David Rockefeller para Estudios Latinoamericanos y en el Consejo Asesor para América Latina de HBS.

Related Articles

Chocolate: Editor’s Letter

Is it a confession if someone confesses twice to the same thing? Yes, dear readers, here it comes. I hate chocolate. For years, Visiting Scholars, returning students, loving friends have been bringing me chocolate from Mexico, Colombia, Venezuela, Ecuador, Peru…

El jardín pandémico

English + Español

Imagine the tranquility of a garden. With the aroma of flowers mixed in with the buzzing of bees and the contrast of shady trees against the fierce Paraguayan sun. From the intimacy of a family garden in which daily ritual leads one to water the plants, gather up the dry leaves…

What’s in a Chocolate Boom?

English + Español

Peru has a longstanding reputation for its quality cacao. In the past decade, it has also attracted attention as a craft chocolate hot-spot with a tantalizingly long list of must-try makers. Indeed, from 2015 through 2019, a boom of more than 50 craft chocolate…