Brazil’s Oil Scandal

Public Malaise, Institutional Resilience

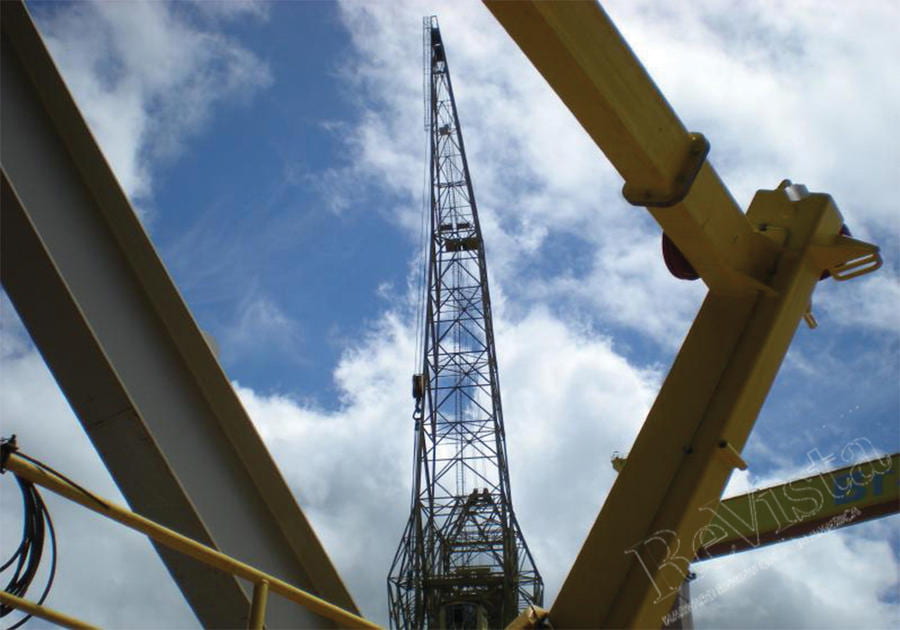

Petrobras facilities: the oil boom led to the resurgence of entire sectors like shipbuilding and the construction of a colossal refinery complex. Photo courtesy of Jason Dyett.

“Brazil has changed.”

When I moved to Brazil in the giddy days of 2011, many people were voicing that phrase. After all, the economy seemed to be sizzling after posting 7.5 percent growth in 2010. So many professionals were moving to Rio de Janeiro and São Paulo, including highly-skilled Brazilians returning home from abroad and Americans and Europeans fleeing stagnation in their own countries, that finding an apartment in those cities was an ordeal involving visits to dozens of run-down properties, negotiations of astronomic sums and pleas with sadistic landlords. Brazil’s currency was so strong that Latin America’s largest country was emerging as one of the United States’ largest creditors. Brazilian authorities built up massive holdings of U.S. Treasury securities in an attempt to prevent the real—the country’s currency— from strengthening further and eroding the competitiveness of Brazil’s exports.

Change was also palpable on the street level in Rio, where so-called “pacification” security forces were expanding their sway in favelas that had long been under the control of drug gangs. Construction crews were overhauling neighborhood after neighborhood as officials prepared the city to host a series of megaevents, including the United Nations’ Rio+20 Conference on Sustainable Development, the 2014 World Cup and the upcoming 2016 Summer Olympics. Meanwhile, the resurgence of entire sectors like shipbuilding and the construction of a colossal refinery complex near the city were winning plaudits for Petrobras, the national petroleum company. The oil giant, based in a brutalist-style headquarters in the old center, was bolstering its role as the linchpin of a development policy aimed at reviving old industries, developing new ones and fomenting a nationalist aura in the process.

Petrobras, the Brazilian national oil giant, was a linchpin of a development policy aimed at reviving old industries and developing new ones. Photo courtesy of Jason Dyett..

In yet another sign that Brazil’s moment on the world stage had arrived, just a year earlier, in 2010, a Brazilian oilman named Eike Batista went on the Charlie Rose television show and proclaimed, “We believe that in five years Brazil will be the fifth-largest economy in the world,” while citing the crucial importance of Brazil’s coveted offshore oil fields in achieving this ambition.

Epitomizing the sense of confidence that imbued Brazil’s business establishment at the time, Batista also had some advice to offer the United States. “You need to be a little bit more Spartan,” said the tycoon, who used to keep a Mercedes-Benz SLR McLaren valued at about $500,000 parked in the living room of his mansion in Rio’s exclusive Jardim Botânico district. He added, “You have to start thinking out of the box.”

As if awakening to bad hangover, Brazilians are now finding that the excesses of the country’s recent oil boom—the hubris, the spending on grandiose development projects and the massive bribery scheme at Petrobras unearthed over the past year by dogged prosecutors—were in a league of their own, revealing fissures in a model of state capitalism in which vast powers are granted to bureaucrats placed at the top of a maze of state-controlled banks and energy companies. As Brazil struggles with a multiyear slowdown—the economy is expected to contract almost a quarter this year in dollar terms, making the goal of ascending into the elite club of the world’s five largest economies more elusive—some are seeking explanations for the malaise gripping the country.

A research survey released in May by Ibope, the prominent Brazilian polling company, found that the number of Brazilians expressing optimism about Brazil’s future had fallen to 21 percent, the lowest level in 22 years and a stunning turnaround for a country which, anecdotally at least, has consistently ranked among the most optimistic I have covered. Since the end of the authoritarian rule in the 1980s, Brazil boasts achievements such as the lifting of millions out of extreme poverty; the democratic election of presidents like Fernando Henrique Cardoso, Luiz Inácio Lula da Silva and Dilma Rousseff, all of whom suffered under the dictatorship; and the robust expansion of its tropical agricultural prowess, a development helping to feed the world. But despite such feats, Brazilians feel less confident now about the future than in the years before Petrobras began making its major offshore oil discoveries about a decade ago.

Of course, Brazil is much more than a developing-world oil producer, boasting a diversified industrial base, including world-class manufacturers like the aviation giant Embraer, and exploiting many other coveted resources including soybeans, iron ore, rare earths, sugar, huge cattle herds and orange juice. While exploring the underpinnings of Brazil’s latest boom, both in oil and other coveted resources, and the challenges it produced, I rediscovered a gem of an article describing an earlier time of exuberance in Brazil. It began prophetically with a quote from a Brazilian business leader: “In 10 years, Brazil will be one of the great powers of the world.”

In an eerie way, those words echoed the bullishness of Eike Batista and other establishment figures when Brazil’s economy appeared to be soaring in this century’s first decade. But the phrase was not uttered in 2010; it was actually from the opening of a front page article in the Wall Street Journal on April 14, 1972. Coming after four years in which Brazil’s economy had expanded on average almost 10 percent a year, a time of exceptional growth that came to be known as the “Brazilian miracle,” this was the assessment of a Brazilian banker interviewed by Everett G. Martin, an award-winning correspondent for the Journal. I had dug up the piece years ago while I was based in Caracas for The New York Times and researching the origins of another oil boom, in Venezuela under the late President Hugo Chávez (more on that below.)

Even now, 43 years after it first appeared, the article offers insight into Brazil’s emergence as a major industrial power—although one that operates in an environment of acute social inequality. In the 1960s, just one commodity, coffee, had accounted for about 70 percent of exports; by 1972 coffee accounted for less than a third. The giddiness that I encountered upon moving to Brazil in 2011 also seemed to be the prevailing mood in the business establishment back in 1972, reflected in spirited statements by automotive and paper executives. While the article acknowledged that Brazil’s military dictatorship since 1964 “hadn’t created the ideal society,” citing as obvious problems the torture of political prisoners and the millions who still lived in poverty, broad credit was bestowed on Antonio Delfim Neto, the powerful finance minister during the dictatorship who helped orchestrate the economic “miracle” with policies such as price controls, tax incentives to boost export-oriented industries, the establishment of factories in the poor Northeast and the regular adjustment of wages, pensions and rents to accompany relatively high inflation.

This development model came under stress during the oil price shocks of the 1970s, exposing Brazil’s reliance on imported oil and ushering in attempts to ease this dependence, including the development of the country’s ethanol industry. By the 1980s, Brazil was grappling with stagnation, hyperinflation and a simmering debt crisis. The radical restructuring of the economy in the 1990s, which included the introduction of a new currency (the real) and the privatization of an array of public companies, lured greater foreign investment. Petrobras, the oil giant founded in the 1950s during a time of growing resource nationalism, was a cornerstone of this shift. Authorities thoroughly exposed Petrobras to market forces, putting an end to the company’s monopoly on oil exploration in Brazil while maintaining state control of the oil giant. Within a few years, this strategy seemed to pay off as Petrobras competed nimbly with oil companies around the world, stunning the global energy industry with its technical capabilities and its success in finding oil in deep-sea fields. The rise in Petrobras’s fortunes marked a turning point for the company, which in the 1950s had hired a U.S. oilman, Walter Link, the former chief geologist for Standard Oil Company of New Jersey (now Exxon Mobil), to lead a quest to discover Brazil’s oil reserves. The tepid results in those first years after Petrobras’s creation forecast a drawn-out dependence on foreign oil, a problem with which Brazil had grappled for decades. But the stars finally seemed to be aligning in Brazil’s favor when Petrobras began racking up one oil discovery after another.

Brazilian authorities emphasized their belief that the country was prepared to harness the coming oil bonanza. They were convinced they could avoid the usual pitfalls, from mismanagement to corruption and political infighting, that often plague other oil-rich countries in the developing world. Seeking to bolster the economy through job creation and assert greater sway over Petrobras and other areas of Brazil’s oil industry, Rousseff, then the chairwoman of Petrobras’s board and the chief of staff to President Lula, supported legislation which enhanced Petrobras’s control over new oil fields and required the company to buy ships and drilling rigs from Brazilian suppliers. Drawing inspiration from oil-rich countries like Norway which squirrel away oil revenues for future generations, Brazil’s government also created a sovereign wealth fund in 2008 to prepare for lean times. Ebullient predictions about Brazil’s rise as a developing-world powerhouse soon became fashionable. “We used to say that Brazil was the country of the future, and I think the future has arrived,” a former high-ranking executive at Petrobras told Forbes in 2010. “Our country is in a unique moment,” he added. “We would have to make many mistakes to not get it right.”

Fast forward to Brazil in 2015. Prosecutors now say that executives of the oil giant were putting into motion a far-reaching and labyrinthine graft and kickback scheme, one of the largest scandals in the history of Brazil: at the same time political leaders were proclaiming that Petrobras’s oil discoveries were the equivalent to a “winning lottery ticket.” Critics of the government’s handling of Petrobras argue that the legislation requiring the company to buy its equipment domestically had the effect of turbocharging corruption. At the same time, Petrobras faces a daunting test of its capacity to oversee an array of devilishly complex exploration projects as a result of the measures expanding its power in Brazil’s energy industry. In June, Petrobras cut its global production target for 2020 to 3.7 million barrels a day of oil and natural gas equivalent from 5.3 million. Brazil’s political and business establishments are still absorbing the shocks emanating from the Petrobras scandal as individuals who have made plea bargain deals describe a scheme in which executives at some of Brazil’s most prominent construction and engineering firms paid bribes to Petrobras officials, who then enriched themselves while channeling a portion of the funds to Rousseff’s own Workers’ Party and other political figures in her coalition. (Curiously, this was happening while another major scandal was coming under intense public scrutiny, the so-called mensalão vote-buying scheme involving top figures in the Workers Party. The trial of these politicians was considered a rare breakthrough in political accountability in Brazil’s political system.) The revelations of corruption within Petrobras have coincided with an economic slump eroding Rousseff’s popularity. In one sign of shifting fortunes, California, with a population about five times smaller than Brazil’s, recently surpassed the Latin American country as the world’s seventh-largest economy. Even the sovereign wealth fund, conceived as an underpinning of an effort to plan wisely during the boom, has fallen victim to the grimmer reality now prevailing in Brazil. In an effort to meet budget targets in 2012, officials raided the fund, leaving it with just a fraction of its holdings.

Of course, Brazil has gone through boom-and-bust cycles before. Historians point out that the country is arguably on stronger financial footing now than in the past. The central bank holds $367 billion of foreign currency reserves, dwarfing the assets at its disposal in earlier periods of distress. Far from large cities like São Paulo and Rio, agricultural pioneers continue to thrive even as the prices of some commodities have softened. Still, as Petrobras’s travails ricochet in the national economy, the mood swings in Brazil remind me of the prophetic assessments about handling oil bounties by Juan Pablo Pérez Alfonso, a once-towering figure in Latin American and global oil politics who regrettably remains less remembered than he should be. A Venezuelan lawyer and cabinet minister educated partly in the United States, Pérez Alfonso helped create OPEC in 1960, contending that oil-producing nations needed a cartel to exert greater control over their oil resources. But over the years he grew increasingly disillusioned with OPEC and with Venezuela’s own triumphalism over its oil bounty. He retreated into his walled hacienda in the district of Los Chorros in Caracas, which he maintained as a kind of oasis in the frenetic capital of a country whose prospects in the 1960s and 1970s seemed just as promising as Brazil’s did just a few years ago. Blasting authorities who prioritized pharaonic megaprojects made possible by petroleum wealth while neglecting essentials like education, he bluntly called oil “the excrement of the devil.” “A wave of money can destroy as well as create,” he warned before his death in 1979 at age 75.

Construction of Petrobras oil exploration equipment in Angra dos Reis, Rio de Janeiro. Photo courtesy of Jason Dyett.

To be sure, Venezuela, a smaller country which emerged as the world’s largest oil exporter in the 1920s, has a much longer history of dealing with the blessings and curses of being an energy power than Brazil, which has developed a far more diversified economy in recent decades and now wields considerable economic clout in Venezuela. But in a sign, perhaps, of rising political polarization in Brazil, some Brazilians are drawing comparisons between the challenges faced by residents of both countries as disenchantment with Rousseff’s handling of the economy escalates. Petrobras remains under the cloud of scandal and the country follows the cautionary tale of Eike Batista, the oil tycoon whose vast empire has crumbled. Nevertheless, the nurturing of independent institutions in Brazil suggests that the country’s problems occur in a different realm than those in Venezuela, where dilemmas include soaring inflation, acute shortages of basic products and a crackdown on the government’s political opponents. In Brazil, a crucial streak of judicial independence has allowed officials from the Federal Police, a respected institution comparable to the F.B.I. in the United States, and counterparts in the Public Ministry, a body of independent prosecutors, to dig deeply into the graft scheme at Petrobras. Going further, Brazil’s highest court has authorized investigations of some of the country’s most powerful political figures, including the leaders of both houses of Congress, over claims that they benefited from the kickbacks. At the same time, even as Rousseff faces calls that she should be impeached over scandal, she has adopted a largely non-confrontational approach to those calling for her ouster, avoiding the poisonous tenor of some political leaders in neighboring countries. Strikingly, Petrobras, while dealing with an array of challenges stemming from the scandal producing upheaval in its executive suites, remains innovating on the cutting edge of deep-sea exploration technology. In a milestone largely ignored as graft revelations swirl around the oil giant, Petrobras disclosed that its petroleum output (excluding natural gas) recently surpassed that of Exxon Mobil.

Brazil still faces huge challenges as it deals with the excesses which accompany oil wealth. Political figures under the oil scandal’s cloud are reportedly maneuvering in an attempt to prevent the prosecutor general overseeing the inquiry into the graft scheme from securing a new term, and Rouseff has voiced doubts over the testimony of executives who reached plea bargain deals with investigators.

If history offers any lessons and Brazil booms yet again a decade or two from now, business leaders might still be prone to making wildly exuberant statements. Oil, or other coveted natural resources, might play an even larger role in the next boom than in the last one. But has Brazil really changed? Undeniably yes, but perhaps not in the way its enthusiasts proclaimed back in the go-go days of 2010. The vital test which Brazil now faces suggests that some of the demons from its past may have been less tamed than once thought. But the quiet transformation of Brazil’s institutions offers a glimpse into the resilience that may allow the country to pick up the pieces and bolster its democratic experiment.

Fall 2015, Volume XV, Number 1

Simon Romero, the Brazil bureau chief for The New York Times, is a 2015 Maria Moors Cabot Award winner. He covers Brazil and several other countries in Latin America, including Argentina, Chile, Paraguay and Uruguay. He was previously the newspaper’s Andean bureau chief from 2006 to 2011, based in Caracas, Venezuela, and a national financial correspondent based in Houston, Texas, from 2003 to 2006, covering the global energy industry.

Related Articles

In the Shadows of the Extractive Industry

English + Español

A telltale detail gave away the changing way of life for the indigenous Machiguenga women living around Peru’s most important gas project in the…

Wind Energy in Latin America

English + Español

Carlos Rufín is Associate Professor of International Business at the Suffolk University’s Sawyer Business School, and a consultant on energy matters to the World Bank and the Inter-American Development Bank…

Routledge Handbook of Latin America and the World

On December 17, 2014, after U.S. President Barack Obama and Cuban President Raúl Castro simultaneously announced the decision to move towards…